Stewardship report 2022: themes and context

Against a tumultuous backdrop, we believe it is now more important than ever to influence company behaviour through effective and robust stewardship. As a responsible asset manager, we see stewardship as a vital mechanism to power a just and green transition.

Our experts examine the trends that characterised 2022 across engagement and voting, the macroeconomic environment and the public affairs and regulatory landscape.

Highlights and data

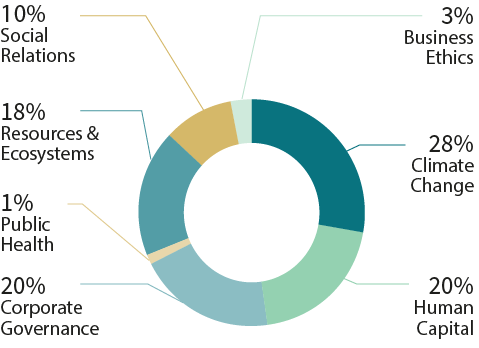

In 2022, we have made 596 commitments to companies, including 480 from of committed issuers and governance was our key theme of discussion, with 24% of cases covering corporate governance matters.

Read more about our engagementsThe financial sector faces increasing scrutiny about how it addresses climate change and global societal challenges. Our exclusion policies set clear red lines and send a strong message to companies on what we consider unsustainable activities, but we also rely on our stewardship strategy to push investee companies to address key ESG risks and implement best practice

Climate change

Climate change is one of the central pillars of AXA IM’s engagement with companies, representing 28% of our engagement activity in 2022.

Biodiversity

At AXA IM, we are committed to biodiversity protection. At AXA IM, we are committed to biodiversity

protection. Throughout 2022, we continued to reaffirm this commitment through a series of actions.

Gender diversity

We believe gender diversity is a key factor in achieving and maintaining a healthy and efficient working environment.

Responsible technology

The collection of personal data has fuelled the rapid growth of internet based technology companies.

Why We Shouldn’t ‘Just Quit’ Coal

In this podcast, Tim Gould, Chief Economist at the IEA, and our in-house experts, discuss AXA IM’s role as an investor in engaging with companies in their more ambitious targets.

Active engagement: case studies

In line with our engagement policy, at the beginning of each engagement, we defined clear objectives and a corresponding timeframe to allow investee companies to achieve those. When progress is too slow or when the level of responsiveness is not satisfactory we can use escalation techniques.

One technique is to co-file a shareholder resolution at a company's annual general meeting (AGM) alongside other investors. Read about why we have chosen to escalate in that way with some of our investee companies.

Voting: our priorities and plans

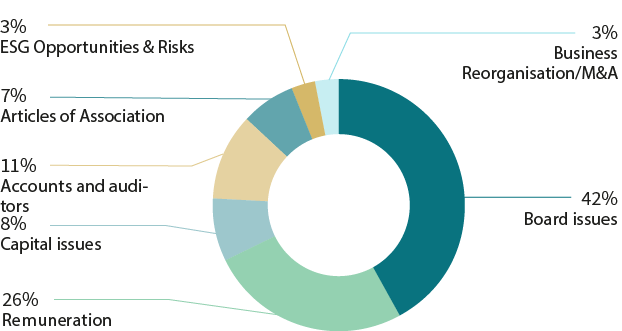

During 2022, we have voted a total of 58,073 proposals at 5,179 meetings, representing 96.9% of the meetings we could vote on.

Find out moreLast year was rich and particularly eventful for ESG. As we begin 2023, we are taking the opportunity to look back at the impact of the 2022 updates of our voting policy, addressing ESG issues through voting.

ESG accountability of boards of directors

For companies particularly exposed to environmental or social risks, we sought guarantees that the most material issues are appropriately monitored by boards of directors.

Executive remuneration

One of our main policy updates for 2022 related to the inclusion of material and measurable ESG metrics in executive remuneration, reflecting our stance that ESG-linked pay signals the credibility of the top management’s commitment to the company’s corporate social responsibility (CSR) strategy.

Our approach to environmental and social shareholder proposals

At AXA IM, we seek to carefully analyse each proposal on its own merits. We have a clear stewardship approach which frames how we decide whether to support environmental and social resolutions.

Supporting a shareholder resolution, and then?

Most environmental and social shareholder proposals are being filed in North America, where the legal scope of such resolutions is only advisory.

Sound Progress

Sound Progress is our podcast series showcasing the people driving real progress on climate commitments.

ListenOur vision for 2023

- Increase the number of engagements while maintaining a high level of quality in our discussions and processes as we seek to improve the chances of seeing engagement succeed. This will require the continued collaboration with investment teams and analysts as key partners in the process, as we continue to integrate ESG and upskill the teams.

- Improve oversight of the engagement process to increase the chances of achieving the desired change within the company. This may lead us to using escalation more often or working with peers or asset owner clients as part of collaborative initiatives. In an ever-more complex world, it is our belief that collective action remains an effective way to facilitate this and we will continue to play our role in collaborative initiatives.

- Develop engagement in alternative asset classes as a key priority as we reinforce our footprint in this market, including in the real estate space with tenant engagement.

- Pursue public policy efforts, on sustainable finance aspects, but also real economy issues, and acting with industry groups to do that, such as the Institutional Investors Group on Climate Change. We believe government action is needed to help accelerate an orderly transition to a more sustainable world, thus helping to improve the chances we can deliver long-term robust performance for our clients.

Transparency will remain a key priority for us, and we intend to improve our engagement reporting capabilities at fund level. We will also continue to set out clearly where we see challenges on our path to net zero.

A simple and transparent way to track progress towards our net zero goals.

The AXA IM for Progress Monitor is a selection of eight metrics with interim targets, chosen for their strategic importance and material contribution towards the firm’s goal of becoming net zero as a business and investor by 2050.

Learn moreOur reports and policies

Through our engagement activities, we seek to use our influence as investors to encourage companies to mitigate environmental and social risks relevant to their sectors.

Related content

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk , including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested.