Sustainability at AXA IM

We are committed to driving the transition to a sustainable future while aiming to provide strong financial performance for our clients.

Our Sustainability Journey

Our goal is to provide investors with sustainable investment solutions which enables them to stay ahead in a rapidly evolving landscape.

Download our Sustainability Report

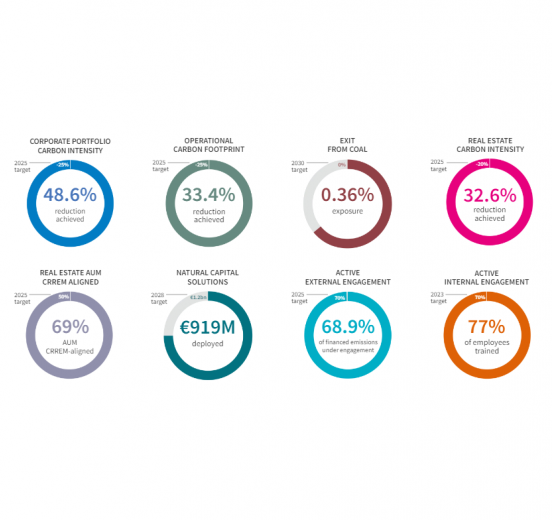

AXA IM For Progress Monitor

We aim to ensure our non-financial targets are as visible as our financial objectives. To achieve this, we developed the AXA IM For Progress Monitor: a simple and transparent way to track our net zero journey.

Learn more about AXA IM For Progress Monitor