Taking action to create meaningful impact

We are an active steward helping to catalyse solutions that benefit society and the planet.

We have already seen signs that the global economy is starting to move to a more sustainable and equitable model over the next decade, and we will take an active role in powering that transition.

We engage for good

We are not a passive partner for clients – we are an active owner of assets on their behalf.

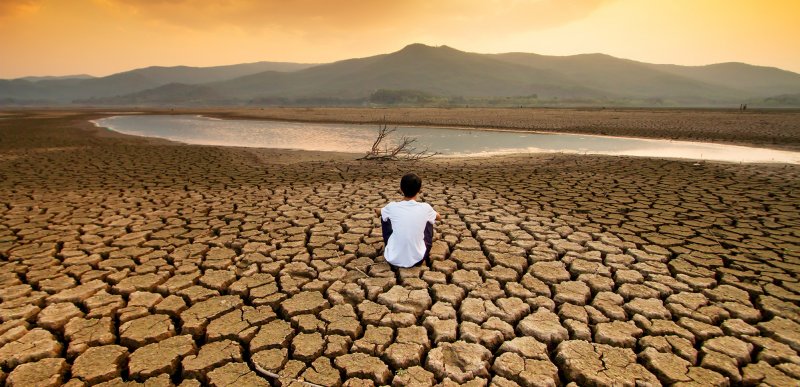

We act decisively on climate issues

The road to a net zero world is challenging to navigate and requires a collective effort. Every individual, company, and government must play its part.

We invest for purpose

In everything we do we are committed to creating positive and measurable progress for the global economy, the planet, and the communities in which we live.

We put ESG at the heart of our RI approach

We define responsible investing (RI) as an investment process that incorporates environmental, social and governance (ESG) factors into its approach.

We partner for change

We actively seek out partners who share our ambitions, and are an active voice in many important industry initiatives. We seek to lead by example by embedding sustainability into our business practices and culture.

Our investment platforms approach

Visit our investment websites to find out more about our responsible investing approach

Select the websiteFind out more

How to invest for the people and planet

Our ACT range is designed to enable our clients to invest in the companies and projects leading the transition to a more sustainable world.

Visit our Core investments website for moreSustainability-Linked Bonds

Sustainability-Linked Bonds: Our assessment methodology

AXA IM is committed to the idea that investors will be better positioned if they acknowledge and address climate change and sustainability in their portfolios. This has prompted us to carefully monitor the arrival of a new type of fixed income asset class – Sustainability-Linked Bonds.

Technology and human rights

Technology and human rights risks: An upstream and downstream approach for investors

Investors have a key role to play in better addressing and mitigating upstream and downstream human rights risks in the technology industry.