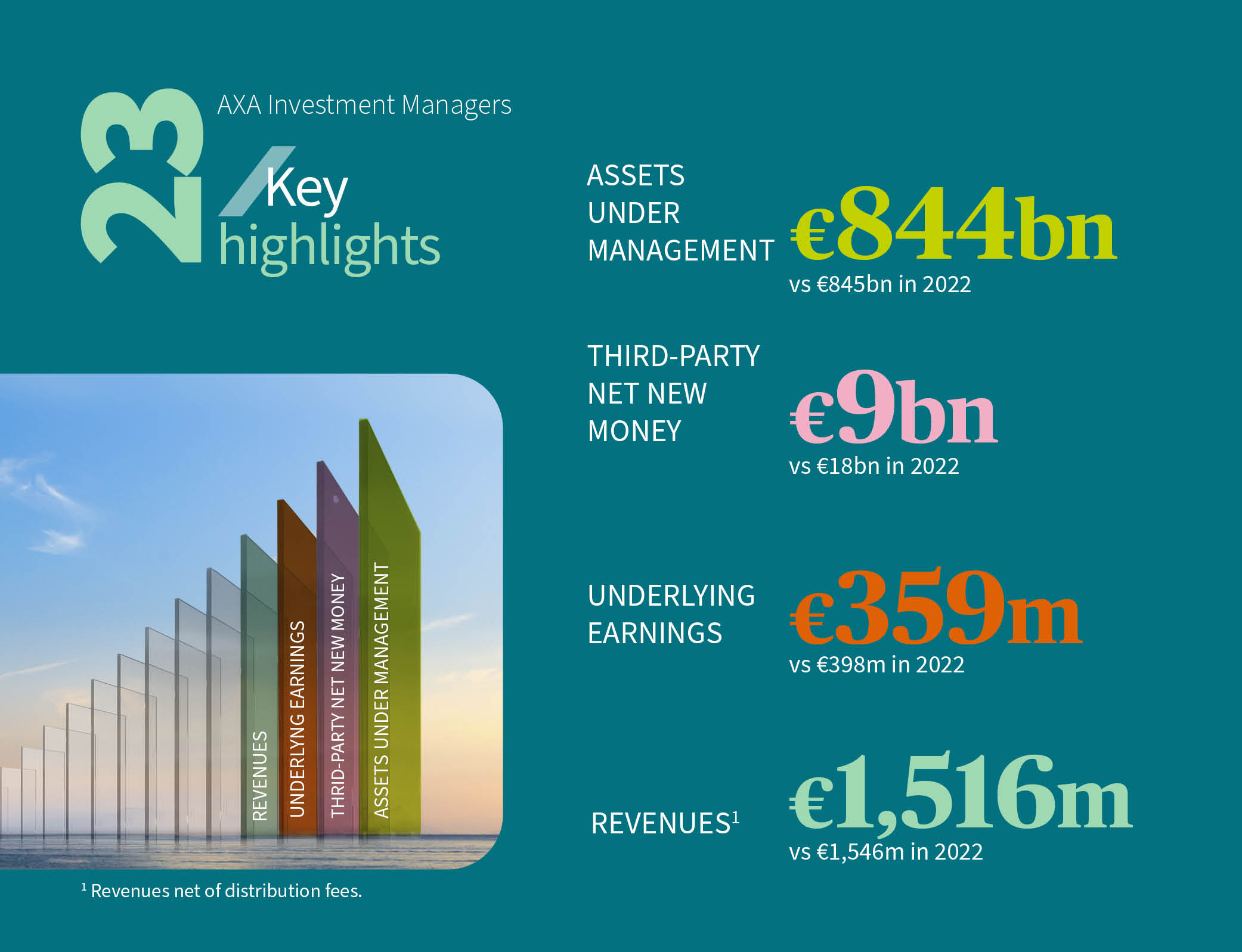

Full-year 2023 earnings

- Net third-party inflows of €9 billion

- Asset under management at €844 billion

- Net Revenues at €1,516 million

- Underlying earnings at €359 million

“2023 has been another challenging year for asset managers and investors, with geopolitical events and inflation running high. Despite these challenges, we have demonstrated the resilience and the relevance of our business model to navigate all market conditions.”

“Our teams remained dedicated to working closely with our clients, delivering the strategies and solutions to meet their investment needs, fuelling strong sales momentum with positive inflows from third party clients mainly generated by AXA IM Alts and AXA IM Core,” said Marco Morelli, Executive Chairman of AXA IM.

“We’ve reported on the first edition of our AXA IM for Progress Monitor, which transparently tracks progress towards our goal of becoming a net zero business and investor by 2050. Metrics show we are making progress towards net zero, through decarbonisation actions in our portfolios and as a business. Notable highlights include increased capital committed to natural capital solutions as well as robust engagement activities with investee companies. We remain determined to take action and lead the green transition for a more sustainable, fairer, and inclusive future.”

“We have now completed the full consolidation of all AXA Group’s asset management activities under one roof to capitalise on their combined strengths in order to drive growth, and to offer new investment opportunities to our clients. We now have four business units, AXA IM Alts, AXA IM Core, AXA IM Prime and AXA IM Select, each with distinct propositions and dedicated expertise.”

“Our convictions are steadfast, and we must continue to generate sustainable growth and adapt to evolving market conditions, so that we can innovate and deliver value for our clients. By playing to our strengths, we are ready to enter our next strategic phase.”

Full-year 2023 key highlights

All figures are sourced by AXA IM as of end 2023, unless otherwise specified.

2022 figures have been restated to include the contribution of AXA IM Select for the comparison with 2023.

Net flows amounted to €-11 billion, comprising of:

- €+9 billion from third-party clients, with positive inflows mainly coming from institutional fixed income and alternative clients.

- €-15 billion from AXA insurance companies, coming from outflows in savings products.

- €-5 billion from joint ventures in Asia, driven by outflows in China as Residential Mortgage-Backed Securities (RMBS) as a result of lower interest rates which triggered termination of contracts.

Assets under management (AUM) amounted to €844 billion, down 1 billion compared to the end of 2022, reflecting outflows as well as negative FX effect, despite positive market effect linked to the good momentum on financial markets at the end of the year.

Net Revenues are down 2% at €1,516 million1, driven by a decrease in recurring fees due to a lower asset base as a result of adverse financial markets, as well as lower transaction fees, partly offset by an increase in performance fees.

Underlying earnings are down 10% at €359 million2, mainly as a result of lower revenues. On a reported basis, underlying earnings are up 3% vs. 2022.

The underlying cost income ratio stands at 71.7%, as a result of lower revenues and higher costs, partly offset by cost containment measures.

- Revenues net of distribution fees.

- At constant FX.

2023, the year of Private Debt & Alternative Credit for AXA IM Alts

AXA IM Alts brings together real estate, infrastructure, alternative credit and natural capital & impact investments expertises of AXA IM.

- The Alternative business unit recorded €4 billion of net new money3 from third-party clients, with good momentum in private debt and alternative credit.

- Assets under management stand at €183 billion.

- Revenues stand at €626 million.

In a year that has seen a further slowdown in capital raising and investment volume overall, AXA IM Alts has managed to capitalise on its strength and extensive product offering to swiftly adjust to a challenging market environment.

As an illustration of this, 83% of the capital raised from third party clients was directed towards private debt & alternative credit (vs 49% in 2022), reflecting both the renewed appetite from client for those strategies in a higher interest rate environment and the strength and suitability of AXA IM Alts’ offering in this space.

In terms of asset class, 44% of total capital raised was in real estate, largely in Commercial Real Estate debt, a segment where AXA IM Alts has an established leadership position with its €25 billion platform, followed by infrastructure representing 27% of total, a fast growing segment of the business unit and one of the most in demand asset class.

With 26% of total capital raised, alternative credit strategies provided strong contributions in 2023, with a noticeably one from Significant Risk Transfer strategies, an asset class moving from tactical play to become part of a strategic asset allocation and from which AXA IM Alts benefits from a 20-year track record.

In 2023, 41% of total capital was raised outside of Europe, primarily from Asia Pacific and North America, reflecting AXA IM Alt’s position as global leader in alternatives investments.

- Invested capital raised money.

Continued momentum for the Core investment business with third-party clients

AXA IM Core brings together the Fixed Income, Equities, Multi-Asset platforms as well as the ETF business at AXA IM.

- The Core business unit has raised €5 billion of net new money from third-party clients, mainly driven by Fixed Income.

- Assets under management stand at €501 billion.

- Revenues stand at €696 million.

79% of eligible funds and strategies are being classified as article 8 or 94 according to the level II of SFDR.

In this volatile environment, Fixed Income benefited from good momentum from third-party clients specifically favouring global aggregate and money market strategies in the first part of the year, with the largest contributions coming from dedicated mandates. ESG strategies continue to benefit from clients’ interest across all Fixed Income asset classes.

In the second part of the year, clients started to add back some risk in their portfolios which enabled a credit rebound with both Investment Grade and High Yield strategies being in high demand. Additionally, green bond strategies continued to post significant inflows.

A complex market environment combined with a risk-off client sentiment led to a challenging year for the Equity platform mainly due to reallocation by clients. On a positive note, sustainable equity strategies recorded inflows during the year and the Robotech strategy kept traction reaching €3 billion of AUM.

The Multi-Asset platform recorded commercial momentum from new guaranteed products (Euro Medium-Term Note) and an additional impact advisory mandate in Asia.

Thanks to enhanced quant capabilities, a new tool was implemented allowing to optimize liquidity management for AXA.

The ETF business grew significantly and launched four new ETFs, three of which bringing innovation in the active fixed income ETF arena on US and European credit markets and one equity ETF tracking a Paris Aligned benchmark. The ETF business successfully attracted flows from a wide range of third-party clients across the globe and its AUM now exceeds €1.6 billion.

To serve clients in a better manner with the solutions they need to navigate markets, a new organisation has been implemented as of January 2024 at AXA IM Core, along with efficiency measures.

- Eligible funds. The classification under SFDR may be subject to adjustments and amendments, since SFDR has come into force recently only and certain aspects of SFDR may be subject to new and/or different interpretations than those existing at the date of this press release. AXA IM reserves the right, in accordance with and within the limits of applicable regulations and of the Funds legal documentation, to amend the classification of the Funds from time to time to reflect changes in market practice, its own interpretations, SFDR-related laws or regulations or currently-applicable delegated regulations, communications from national or European authorities or court decisions clarifying SFDR interpretations. Investors are reminded that they should not base their investment decisions on the information presented under SFDR only.

AXA IM Prime continues to execute the expansion plan with consistency

AXA IM Prime provides investors a full range of global alternative investment management across private equity, private debt, infrastructure and hedge funds via primaries, secondaries, and co-investments.

- The AXA IM Prime business unit recorded €2 billion of net new money.

- Assets under management stand at €35 billion.

- Revenues stand at €65 million.

In 2023, multiple milestones were reached by AXA IM Prime. Building on a successful track record in the NAV lending space since 2017 with c. €5 billion invested, the NAV financing platform was opened to third-party clients over the summer and recorded c. €0.3 billion of commitments, mostly deployed in the second half of the year, showing the quality of the pipeline allowing a fast deployment.

Additionally, a private equity GP stakes strategy was launched with c. €0.2 billion of commitment received, the team partners with sponsors to support and accelerate their future growth. Hedge funds well navigated the environment, aiming to deliver a risk adjusted return on the long term, showing the resilience of the approach.

A sustainability policy is currently being deployed in parallel with the development of the product range within the business unit as well as at strategy and investment levels. AXA IM Prime operates in 6 countries and continues to work on broadening its range of private equity, private debt and infrastructure products or customized solutions delivering superior and sustainable performance adapted to clients short to mid-term objectives and long-term goals.

AXA IM Select, the new business unit to establish AXA IM as a recognised investment manager for retail customers

AXA IM Select is the multi-management expertise of AXA IM.

- AXA IM Select business unit had positive retail net inflows, with €1 billion of inflows coming from Asia.

- Assets under management stand at €30 billion.

- Revenues stand at €119 million.

The former AXA IM Architas business unit was rebranded to AXA IM Select in January 2024.

In 2023, overall inflows were flat, as positive flows from Japanese and Indonesian clients were offset by outflows from the Main Fund.

Investment performance strongly recovered from 2022, on an absolute basis and compared to peers5.

- Source: AXA IM, internal methodology.

Progress towards ESG commitments as an investor, business and employer

Further progress has been made by AXA IM in 2023:

As an investor:

- Additional updates to the corporate governance & voting policy for the 2024 season include greater scrutiny on climate lobbying activities for investee companies in high-impact sectors, climate remaining a top priority.

- Additional sustainable strategies were launched in equities and ETF, and new alternative investments were made to deliver positive environmental and social change.

As a business:

- The third AXA IM Research Award was attributed to Dr Anika Haque, for her work on the impacts of climate change on urbanized and disadvantaged areas in the global South6.

- 5 charities supporting education, biodiversity & climate and health initiatives were supported through a commitment to donate 5% of impact range’s fees.

- Overall, over € 750,000 has been donated to charitable organisations by AXA IM in 2023.

As an employer:

- ESG targets are included in the deferred remuneration of the senior executives.

AXA IM is committed to achieve its net zero targets to support an effective green and fair transition, as illustrated by the achievements of the first reporting of the AXA IM For Progress Monitor7, a set of eight metrics with interim targets, selected for their strategic importance and material contribution towards AXA IM’s sustainability related goals.

- See: Dr Anika Haque wins the 2023 AXA IM Research Award for her work on the impacts of climate change on urbanised and disadvantaged areas in the global South | AXA IM Corporate (axa-im.com)

- See: AXA IM has made material contribution towards its goal of becoming net zero as a business and investor by 2050 | AXA IM Corporate (axa-im.com)

Notes to editors:

Disclaimer

This press release should not be regarded as an offer, solicitation, invitation or recommendation to subscribe for any investment service or product and is provided for information purposes only. No financial decisions should be made on the basis of information provided.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.