AXA IM to expand its gender diversity voting policy for both developed and emerging market economies

AXA IM introduces a 33% diversity target for the developed1world from next year

AXA IM will now also begin to target companies in emerging markets on gender diversity issues

AXA Investment Managers (AXA IM) today announces the expansion of its gender diversity voting policy in order to enhance its influence on companies, globally, to improve governance standards.

From 2021, AXA IM will target listed companies in developed market economies where at least one-third of the Board of Directors is not gender diverse2. This new 33% diversity target will enable AXA IM to hold all companies in which it invests to the same high standards of achieving greater diversity, as well as advancing the issue of gender diversity in the developed world.

In addition to these changes, AXA IM will also be targeting listed companies in emerging market economies from this year, as well as Japan, where the Board of Directors does not comprise of a minimum of one female director (or 10% of the board for larger Boards).

AXA IM has and will continue to push all companies, in both developed and emerging markets, to disclose and report against their executive committee gender diversity policy and targets. AXA IM will be holding companies accountable with respect to these targets and will seek to put pressure, through its engagement efforts, on companies that continue to fall short of their defined target or market best practice to explain shortcomings and how they intend to address the situation.

AXA IM may also use its voting power at a company general meeting as a tool to address concerns at companies that fail to provide appropriate disclosure and measures on executive committee diversity and have no credible plan to address the topic.

Yo Takatsuki, Head of ESG Research and Active Ownership at AXA Investment Managers, said: “Studies3show that a well-balanced and gender-diverse Board of Directors leads to higher profitability and value creation, overcomes issues of group think, triggers debates and innovation, and leads to stronger diversity of representation across the organisation. These changes are in line with our belief that we must hold Boards of Directors accountable to best governance standards in their role as guardians of sustainable performance. The introduction of our 33% target for listed companies in the developed world and new policy for companies in emerging markets and Japan, is the next critical step for us as we continue to build on our voting policies around gender diversity, and make the most of our rights as an investor to engage companies in productive dialogue that makes a tangible difference.”

AXA IM’s gender diversity engagement in 2019 focused on pressing companies to proactively seek gender equality at every level of the corporate hierarchy. AXA IM also improved how it incorporated gender diversity considerations into its voting at AGMs, by voting against the following:

Approval of the company’s report and accounts or a relevant director for all-male boards at companies in developed markets;

The chairman of the nomination committee at companies in the UK FTSE All Share Index where less than a quarter of the board is female;

The chairman of the nomination committee or relevant director at US companies with lower than 20% female board representation.

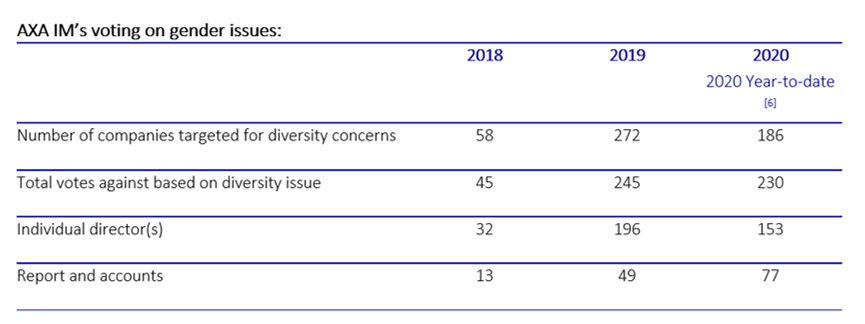

This saw an increase in the number of votes against companies where AXA IM had voted against companies on gender diversity considerations, from 45 companies in 2018 to 245 companies in 20194. From January to May 2020 this year, AXA IM voted against 230 resolutions at 186 meetings based on gender diversity issues5.

Yo Takatsuki, added: “As long-term stewards of our clients’ investments, we believe that the interests of shareholders are best served where the Board of Directors is structured in a manner to ensure that there is an appropriate diversity of skills, knowledge and experience amongst the directors on the board which is suitable for the requirements of the business.”

- As defined by AXA IM: Developed: North America, Asia Developed/Oceania (Australia, HK, NZ, Singapore), Europe Developed. Emerging: Emerging markets, as well as Japan due to its traditionally male dominated board structure.

- AXA IM will specifically oppose the election or re-election of the Nomination Committee Chair where these minimum requirements, are not met. If the election/re-election is not at the agenda, AXA IM will vote against the approval of accounts.

- AXA IM’s Rosenberg (2018) - Does Diversity Provide a Profitability Moat? MSCI Research (2016) - The tipping point : Women on Boards and financial performance Credit Suisse (2019) - The Gender 3000 Report

- Source: AXA IM, 2019 Active Ownership and Stewardship Report, February 2020.

- Source: AXA IM – data sourced from 1st January to 31st May 2020

- Source: AXA IM – data sourced from 1st January to 31st May 2020

Note to editors

About AXA Investment Managers

AXA Investment Managers (AXA IM) is an active, long-term, global, multi-asset investor. We work with clients today to provide the solutions they need to help build a better tomorrow for their investments, while creating a positive change for the world in which we all live. With approximately €804 billion in assets under management as at end of March 2020, AXA IM employs over 2,360 employees around the world and operates out of 28 offices across 20 countries. AXA IM is part of the AXA Group, a world leader in financial protection and wealth management.