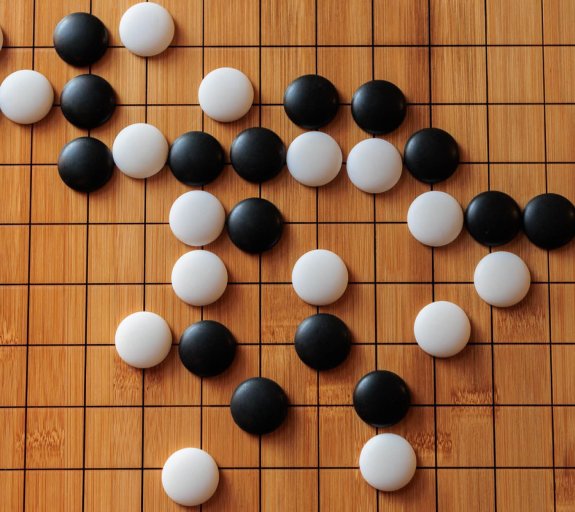

May Monthly Investment Strategy - Joseki in international trade

KEY POINTS

Global trade policies remain in flux

Risk sentiment has surged with the successive reversals of US tariffs. Some of this likely reflects shifts within the US administration, notably Treasury Secretary Scott Bessent’s rising influence – never a tariff advocate. Yet the world’s reaction likely sparked this move. In April we described the financial market’s reaction. However, different economies’ reactions have been important – none more so than China.

China firmly retaliated, leading to a spiralling in tariffs between the two nations, but the impact on China at first glance was not catastrophic. Exports to the US fell by 21% in April but overall exports rose by 8.1% with offsetting boosts particularly to Association of Southeast Asian Nations (ASEAN) countries and the Eurozone. This, and supply restrictions of rare earth to the US appear to have led the US to reverse its punitive tariff levels on China, now up 30% under this administration, even before a trade deal has been struck.

China’s strategy differed from other countries which hunkered down to negotiations with the US. The UK struck the first ‘trade deal’, albeit thin in nature. But after this, the UK only removed tariffs on steel and aluminium exports; other categories remained at 10% (including for lowered car export quotas) up from 3.8% in 2024. Other countries will likely gauge the relative merits of these approaches. Japan has already appeared more belligerent in negotiations, refusing to accept ongoing 25% tariffs on its auto sector. European Union (EU) reaction will be interesting. A 10% tariff on the EU was towards our risk case scenario at the end of 2024 and we think would be sufficient to generate a mild Eurozone recession. It would also likely prompt EU retaliation – on ice during negotiations.

Related Materials

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.