The long view

Go through the thought process. Imagine setting out a 20-year asset allocation plan today. Stocks are at all-time price and valuation highs, bonds are closer to fair value, but credit spreads are super tight. Not easy, is it? Is the traditional mechanistic flightpath asset allocation appropriate for where we are? There are lots of risks potentially materialising. History suggests valuations are a concern for equities, especially in the US. Bonds, however, are set to potentially generate long-term gains close to current yield levels, consistent with average nominal GDP growth. Time is the friend of the long-term view, as should be discipline, rebalancing and compounding. Done correctly, history suggests a 10% compound annual return over a decent horizon is the reward for patience and planning.

- I still like credit in fixed income; it appears solid and demand is strong

- I am concerned about the disconnect between macroeconomic and political risks and markets

What will it take?

In several client meetings recently, the issue of what might burst the ‘risk-on’ bubble has been discussed. I think this reflects a general level of discomfort between perceived threats to the global outlook and markets’ remarkably strong performance. The US narrative continues to add to uncertainty, with the investment thesis around some climate change solutions and selected pharmaceutical products being challenged most recently. The gathering of world leaders at the United Nations General Assembly in New York highlighted the changed world of international relationships and the apparent difficulties in achieving peaceful solutions in Ukraine and Gaza. Leaders gathered against a backdrop of the world trading system being upended by the preference of the US for its own tariff-led approach rather than that of the multi-lateral framework embodied in the mission of the (now less effective) World Trade Organization. At the same time, risky assets are at extreme valuations, there are concerns about inflation, US Federal Reserve (Fed) independence, fiscal stability and a potential US recession. Yet markets appear to be complacent.

Quick or slow?

Picking a single event that would cause a market correction is difficult. Think about Liberation Day in April. What the White House announced should have elicited a negative market reaction. It did, but it didn’t persist because the implementation of tariffs was postponed. There are numerous individual risks to market sentiment – higher US inflation; a monetary policy mistake; a negative bond reaction to fiscal developments in the UK or France; and an escalation of security tensions in the east of Europe. We can’t trade on any one of these risks materialising - or having a long-term impact on valuations. The fact that the VIX index and corporate bond credit default swaps remain low suggests that investors have no appetite for hedging against any of the myriad risks materialising into realistic market drawdowns.

For what it’s worth, my bet is that if there is a market correction, it will be a more drawn-out affair. The US economy is slowing, at least outside of the artificial intelligence (AI) economy, and inflation will be running at an elevated rate for some time as tariff costs are increasingly passed on to consumer prices or reduce profit margins. Meanwhile there are deflationary forces elsewhere in the world. Somehow, it does not seem likely that nominal GDP growth can remain as robust as it has. All G7 countries, except for Japan, had a much lower year-on-year nominal GDP growth rate in the second quarter (Q2) than the average of the previous eight quarters. That has implications for corporate earnings growth and risk premiums.

Long-term expectations

For those that entertain themselves by checking in on LinkedIn on a regular basis, you might have come across posts of charts that show the relationship between market prices (valuations) and subsequent future returns. The most popular suggests current US equity market valuations would – if history is any guide – be consistent with annualised total returns of close to zero over the next 10 years. Using current versus subsequent changes in the price-to-earnings (P/E) ratio alludes to a similar outcome. When the P/E ratio has been near to today’s level in the past, the subsequent five to 10 years have seen between a five-to-10-point decline in the multiple. A 10-point decline in the P/E multiple over the next decade would require annual earnings per share for the S&P 500 to grow by a compound 16% if a 10% return from the market each year was to be maintained. That is asking a lot of AI-related earnings growth.

Of course, history does not guarantee future outcomes. However, there has never been 16% earnings growth over such a sustained period. The risk is the modest deterioration in US GDP growth and inflation extends to more of an economic malaise over time, undercutting risk valuations and returns.

Planning

It’s important for long-term investment strategies to have a view on what total returns might be over the medium term. Target retirement date strategies have become very popular in the US and the UK. These typically have an extended investment horizon, start with a high allocation to equities and gradually derisk as the strategy matures. They are based on the normative assumption that bonds are less volatile than stocks, and provide some diversification, and that as people near retirement they value stable income over uncertain growth. The problem is that recent experience has not been great. Bonds became very expensive in the decade after the global financial crisis, and the re-rating of bonds after 2021 destroyed performance. Savers would have been better served staying in equities since 2000 – the drawdowns in equities after the pandemic and the rates shock of 2021 were soon wiped out, while some bond positions remain underwater.

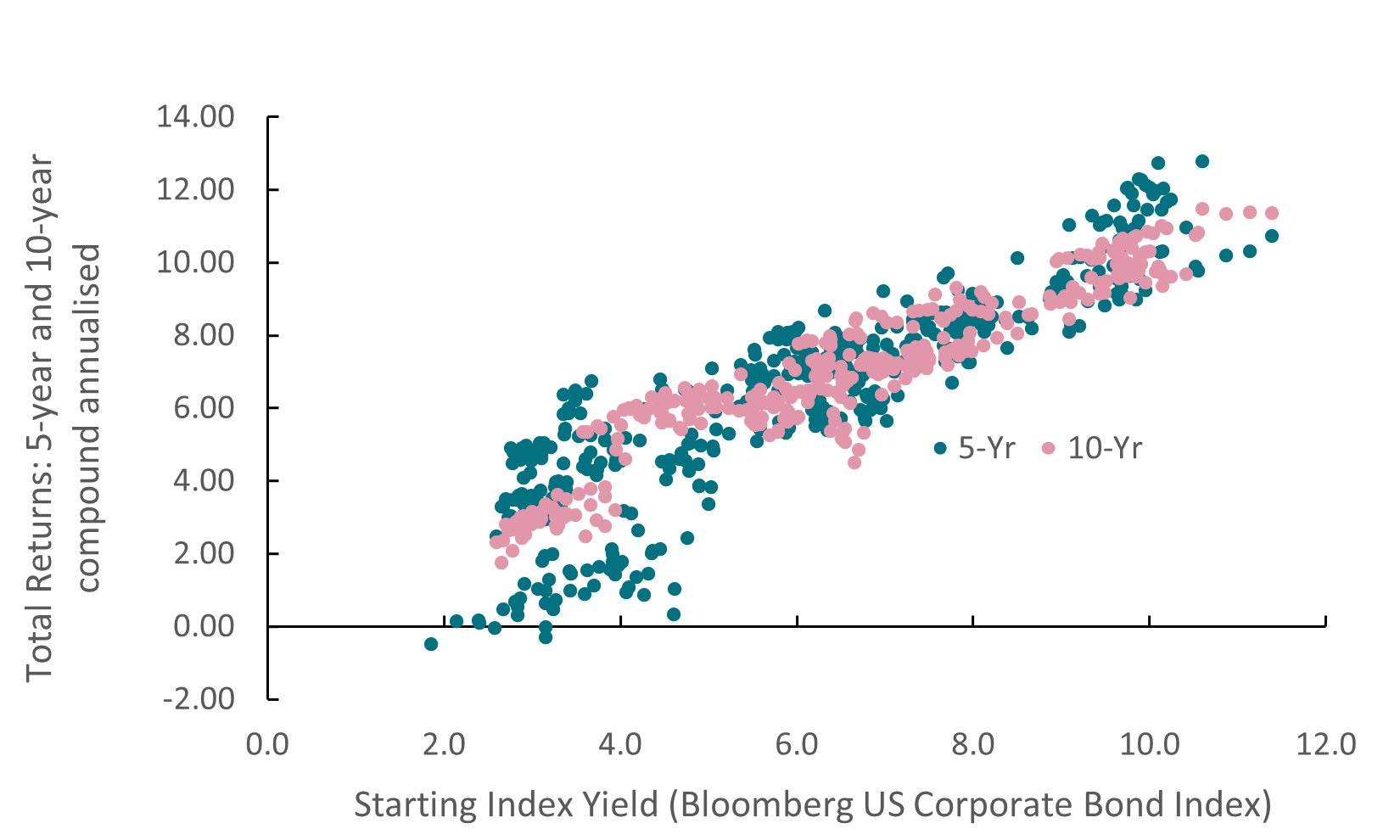

US Corporate Bond Index Returns

Source: ICE Bond Indices; Bloomberg – 25 September 2025

Different glidepath

The good news is that bonds are better value today. Doing the same valuation versus performance analysis, US government bonds - given where yields are today - should tend towards total annualised returns of 4.25% to 4.75% depending on the holding period (based on the regression of all maturity US Treasury yield and subsequent total return performance from a representative index). The data suggests, for US dollar investors, a much more balanced equity-bond allocation. High quality corporate bonds would give a little bit more fixed income performance. Sure, there are inflation and fiscal risks that can create mark-to-market volatility, but I am talking long-term investment strategies here and government bonds and high-grade corporate bonds are extremely likely to remain money good over such time periods. The traditional retirement glidepath might need to have a different starting point given the risks to equity returns from today’s valuations.

For European investors, the balance is in favour of equities over fixed income – a potential 7%-to-8% total return from stocks relative to 2% to 3% from bonds. A more positive view on European equity returns might also incorporate the potential for potential growth to improve if plans to invest in innovation, leverage progress on net zero, and increase spending on defence and infrastructure come to pass. Meanwhile, the frenzy of AI-related spending in the US might diminish at some point.

Ifs and tokens

All of this rests on economic and policy developments. Something must happen to break the US equity market to get multiples down to more sustainable levels. Something must happen to boost European growth. Inflation could again undermine returns from bonds. Moreover, passive allocations over a 30-to-40-year period might not be the most appropriate way to manage one’s retirement. A glidepath approach with decent diversification and some flexibility to change allocations based on contemporaneous valuations and macro developments could be a more fruitful approach. In time, this will also become more cost-effective as mass-market retail retirement investment products utilise technology such as the blockchain to give much cheaper access to underlying market developments. An AI-driven dynamic allocation of exposure to various bond and equity markets through cheap, easy-to-trade tokenised investments could well be the core of the asset management industry of the future.

Performance data/data sources: LSEG Workspace DataStream, ICE Data Services, Bloomberg, AXA IM, as of 25 September 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.