What is the Ageing and Lifestyle theme?

Ageing and lifestyle describes the changing ways that people are living across the globe as life expectancies rise. Ageing populations are one of the greatest social, economic and political transformations of our time.

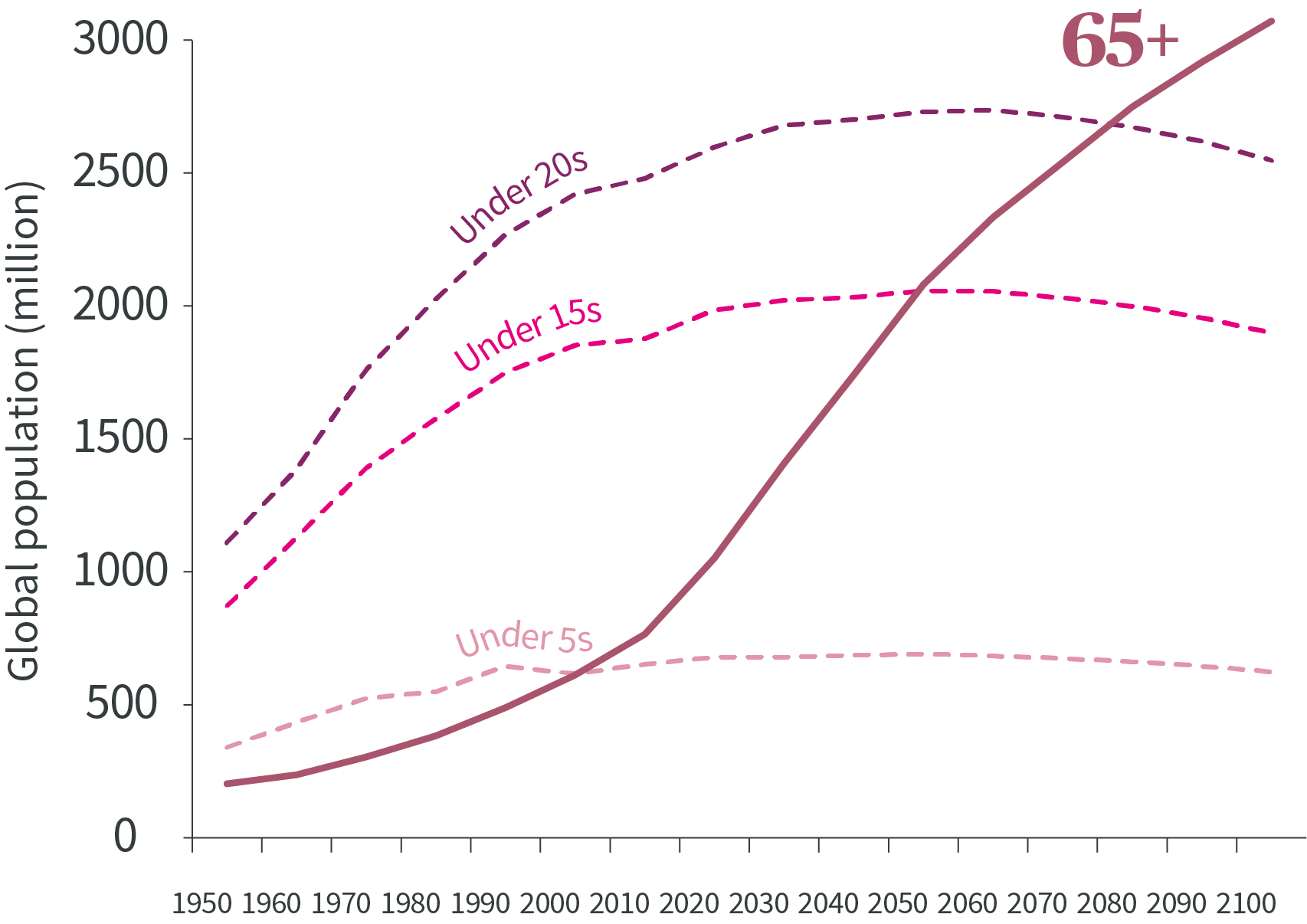

For example, the global 60+ cohort is forecast to grow significantly faster than all other age groups – tripling in size between 2000 and 2050 - creating challenges and opportunities for governments, companies and individuals alike.

Forecasted change in global population size between 2000 and 2050

Source: World Population Ageing, United Nations, 2020; World Health Organisation, October 2021

What are the potential benefits of the ageing and lifestyle theme?

The investible opportunities of ageing populations extend far beyond the obvious areas of healthcare. The changing lifestyles and needs of older generations could represent a multi-decade growth opportunity for investors. By 2030, two-thirds of over-60s’ consumption growth in developed markets will be spent across multiple industries dedicated to living well, from beauty and fitness, to travel and entertainment1 .

Meanwhile other industries like real estate, financials and healthcare will have to rapidly adapt to retiring and elderly generations’ needs.

We invest in companies operating across four areas associated with the economic implications of longevity:

- Silver spending: Industries dedicated to living well; beauty/aesthetics, personal care, fitness, housing, travel, leisure and entertainment.

- Treatment: Companies seeking sustainable treatment solutions for the coming generations.

- Wellness: The wellness industry includes preventative medicine, personalised treatments, nutrition, beauty and anti-ageing treatments.

- Senior care: Markets for senior housing and specialist assisted living facilities, such as Memory Care that focuses on dementia patients.

- VW5pdGVkIE5hdGlvbnMsIGRhdGEgY29ycmVjdCBhcyBhdCBKdWx5IDIwMjA=

The global number of adults aged 65+ now outnumber children under 5.

Source: United Nations, data correct as at January 2022

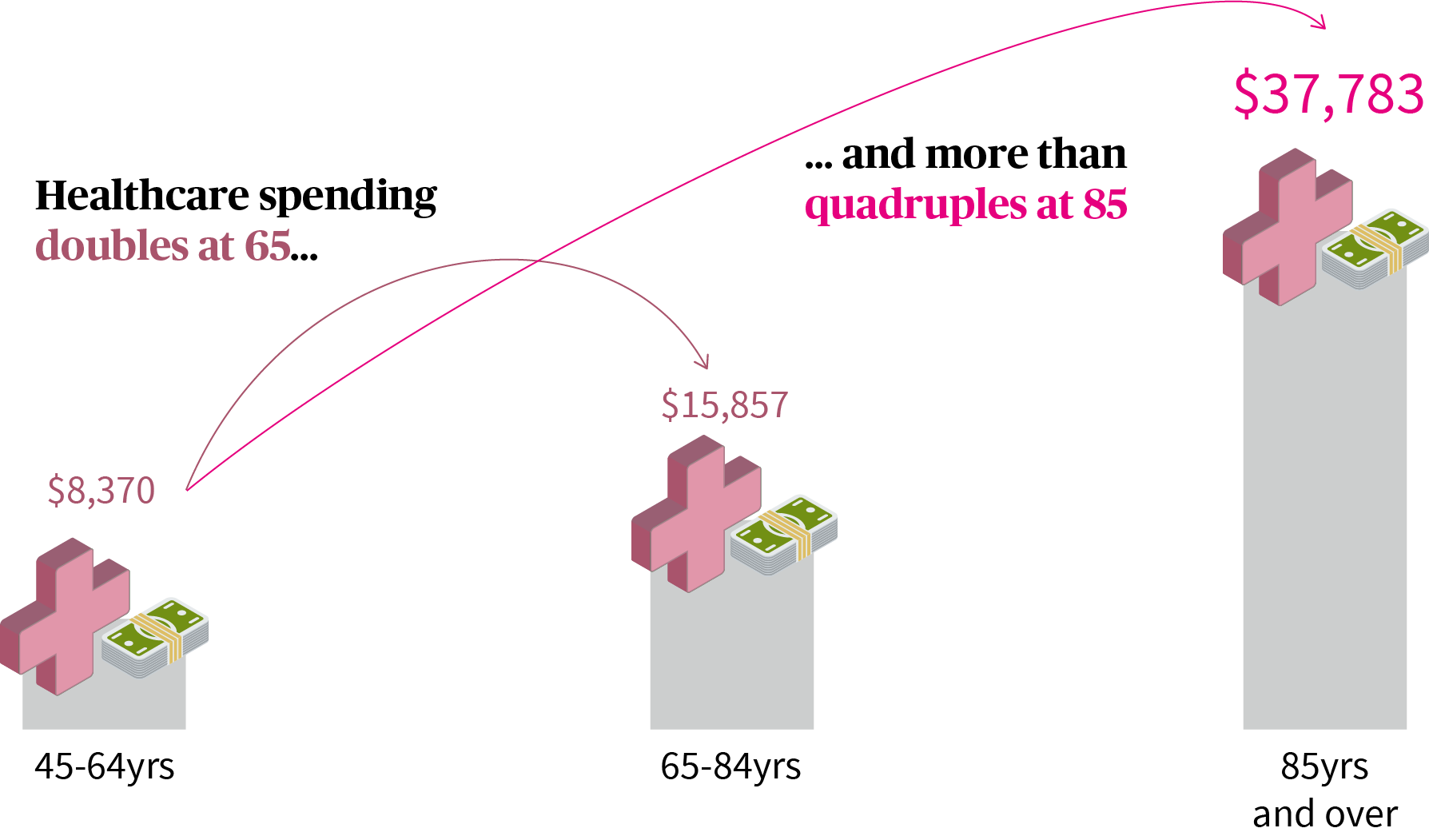

Living longer naturally incurs higher healthcare costs; preventing and treating age-related chronic diseases will be key driver of healthcare spending over next five years. 10,000 Americans hit the age of 65 every day, at which point personal healthcare spending doubles2 .

Source: US Centres for Medicare & Medicaid Services

- SGVhbHRoLWNhcmUgZGlsZW1tYTogMTAsMDAwIGJvb21lcnMgcmV0aXJpbmcgZWFjaCBkYXksIENOQkMsIDMgT2N0b2JlciAyMDE3

That means an additional $28bn of deficit each day, according to the World Economic Forum3 . The increasing onus for individuals to save for, and enjoy, longer retirements gives wealth managers opportunity in an underpenetrated market.

- SW52ZXN0aW5nIGluIChhbmQgZm9yKSBPdXIgRnV0dXJlIOKAkyBXb3JsZCBFY29ub21pYyBGb3J1bSwgSnVuZSAyMDE54oCZ

Visit your local fund centre

Our strategy aims to provide investors with access to long-term growth potential of the ageing and lifestyle theme through four sub-themes.

View fundsTo help people invest in the companies that are embracing these changes, we have adapted our internal research capabilities to incorporate the five main trends that we believe represent the future for long-term fundamental growth investing.

Automation

More industries can now use robotics offering greater sophistication, precision for repetitive or hazardous tasks, and may provide affordable labour solutions.

Connected consumer

Digitalisation empowers consumers like never before with 24 hour, mobile access to a vast choice of products - companies must evolve to remain competitive.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Transitioning societies

A rapidly growing global middle class is likely to create growth opportunities as goods and infrastructure demand shifts from the basic to the aspirational.

Evolving Trends

Discover a single point of access to the five major long-term growth themes we have identified in the evolving economy.

Risks

No assurance can be given that the Longevity Economy strategy will be successful. Investors can lose some or all of their capital invested. The Longevity Economy strategy is subject to risks including counterparty risk, geopolitical risk, liquidity risk, credit risk, and impact of any techniques such as derivatives.