Our stories

Hear first-hand from our people, partners and external experts, as they share their stories on how at AXA IM we are driving progress and serving both the changing needs of our customers, and the world we live in.

Featured article

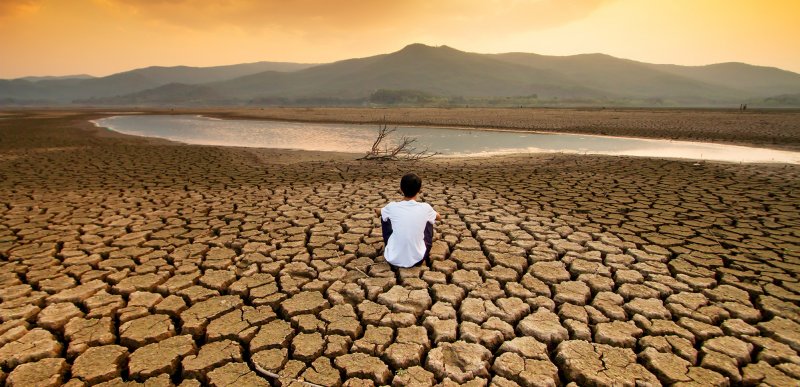

Net Zero – Tracking Progress is ambitious but essential and requires continuous commitment

At AXA Investment Managers, as responsible stewards of our client’s capital, we acknowledge the importance of transparency and accountability in the area of sustainability pledges and we are excited to share insights into our ongoing commitments.Climate change is a risk to us all, and we recognise our responsibilities to our clients, employees, and to society, to act on climate issues. Here, we share stories from our employees and external experts about our efforts and progress to power the transition to a low carbon world.

How AXA IM Research Award has supported winners' research

In a joint interview, hear from our 2021 & 2022 award winners about how the it has been beneficial to their research.

Navigating instability: our convictions

We have entered an era of instability and market volatility which will call on our collective ability to adapt.

How can we make tangible progress towards net zero?

As we reflect on progress after another critical year of action on the climate and biodiversity crises at AXA IM, it is all too evident that the broader road to net zero has been hit with setbacks.

Investing for a sustainable future

Meet Dr. Floor van der Hilst, our 2021 Climate Transition Award winner.

How we enhance climate consciousness

As a responsible business and employer, we are committed to support our colleagues in taking a more conscious role in the fight against climate change.

AXA Week for Good at AXA IM

Where we take collective action for a more sustainable world

Our purpose in action

How we can work together to be a leading responsible asset manager.

We strive for an inclusive work environment built on fairness, equality and wellbeing in which performance and long-term employability can be nurtured. We use our voice as a leading asset manager, pushing for progress on topics such as gender equality. Our commitment to shared value extends to our local communities, supporting them to similarly grow and prosper.

Why paternity leave matters for everyone

In our offices worldwide, we support parents to manage their careers with us whilst also managing the challenges of family life.

We seek to produce long-term profit in a responsible, resilient and sustainable manner. As a responsible investor, we actively use company engagement and voting to positively influence the corporate behaviors needed to drive long term sustainable growth. Whether in the way we identify and manage risk, protect data privacy or run our day to day operations, we seek the responsible way forward.

Our purpose in action

How we can work together to be a leading responsible asset manager.

The Sound Progress podcast showcases the people driving real progress on climate commitments.