Hamilton has not sung yet

- 25 May 2020 (7 min read)

Key points

- The Franco-German proposal for the Recovery Fund is a rare ray of light in an otherwise worrying outlook for the post-pandemic global economy as tensions between the US and China continues to rise.

- We take a quick look at the negative rate debate at the Fed. Legal and institutional constraints may matter as much as macroeconomic concerns.

While the market is understandably more sensitive to the newsflow around a potential vaccine than to economic data, we still focus on the “background noise” which is likely to accompany the mechanical rebound in activity now that lockdowns are being relaxed across most advanced economies. The concerns we expressed last week about financial fragmentation were unfortunately heightened by the US Senate vote of a legislation which would effectively prevent Chinese entities from tapping the US equity market. The Politburo confirmed China’s intention to deliver on the Phase 1 deal struck with the US, but clouds are gathering on global trade in the second half of the year.

There is nothing much Europe can do about these external risks, but at least it can try to keep its internal sources of stress under control. From this point of view, the Franco-German proposal for a EUR 500bn Recovery Fund is an important step forward to address intra-Euro area tensions. This would be “proper fiscal solidarity” since the allocation of expenditure – going to those most in need – would be detached from the calculation of the member states’ contribution to the scheme’s funding.

We dispute the notion that this is a “Hamiltonian moment for Europe”, i.e. the starting point to perennial fiscal federalism. Too many ingredients are still missing. But assuming the opposition of the “frugal states” can be overcome – which we suspect will entail some rebate on their contributions to the EU budget – the capacity to deal with the asymmetric nature of the economic response to the crisis across the Euro area would be significantly improved. There is still “way to go” though on what is likely to be a long negotiation. We suspect we will see more episodes of volatility for the fragile member states. The ECB won’t be “off the hook”.

We usually focus on the constraints the ECB face when engaging in further stimulus, but the re-emergence of the debate on negative rates at the Bank of England and the Fed sheds a light on their own limitations. While the Bank of England is opening a crack in the door, the Fed is still very dismissive. We suspect that in the US case institutional constraints play as much a role as macroeconomic considerations. In general, we are no fan of such policies, but at least the ECB with its ultra-cheap TLTROs has found a way to mitigate the cost to banks.

Data on mute

Markets have been largely insensitive to economic data released last week, and it is understandable. In some cases, they came out above consensus – for instance for the Euro area composite Purchasing Manager Index which rebounded to 30.5 in May, 3 points higher than expected, from 13.6 in April – but all they tell us is that April was the trough. Activity remains very, very far away from any measure of normality. We already knew this from real-time data, and the surveys for now merely reflect the changes to the lockdown conditions rather than any underlying movements in macroeconomic conditions. In the current configuration, PMIs can change by quite a few points without telling us much about what is really at stake: the speed of the recovery once we are fully out of lockdown.

What conversely triggered actual shifts in the market was the pandemic-related news-flow, in particular hopes on a vaccine, or essentially political developments, for instance the Franco-German proposal on the “Recovery Fund”, or the US Senate vote which could result in Chinese entities being in practice unable to raise capital in the US.

We will comment in detail on the Recovery Fund below, but the Senate vote deserves some attention. In a nutshell, the new legislation would make listing on a US exchange conditional on submitting to an audit that can be reviewed by the Public Company Accounting Oversight Board. US and European companies already comply, but this would create a specific issue for Chinese entities, since local law prohibits audits to be transferred out of the country.

Last week we mentioned the risk that “renationalisation” of financial markets emerges as a consequence of the current crisis, with risk-adverse private investors retracting to their domestic markets, the ensuing dearth in liquidity being mopped up by central banks. We also mentioned that the US administration seeking “financial decoupling” from China could turn this knee-jerk reaction to the pandemic crisis into a lasting feature, with financial blocks hardening against each other. Cutting Chinese entities from the US market would be another step in this direction. It could come with immediate adverse consequences for the US markets itself. Indeed, without the contribution from the Chinese companies, the year-to-date performance of the Nasdaq would have been 11% lower.

The Senate vote looks likely to be endorsed by the House as the Democrats don’t want to be seen as “soft on China” ahead of the elections and the bill was sponsored by Senators from the two parties. As usual in these matters the motive behind the move is key. If it is to obtain concessions from Beijing towards more openness to foreign capital, this could ultimately be beneficial for the depth of the international financial system. Conversely, if it is part of a “Chinese containment” strategy which is predominantly motivated by geopolitical concerns, and it is perceived like this in Beijing, then we could expect the resumption of those tensions to alter business confidence in the second half of the year.

At the much-awaited Politburo meeting last week, Beijing confirmed its intention to deliver on the “phase 1 deal” painstakingly negotiated with the US. Their focus is understandably on reviving their economy and another bout of commercial war would not help. On this front the announcements came out as slightly less ambitious than we were expecting on the fiscal side (with a deficit target at 3.5% of GDP), but this should be offset by more monetary accommodation. Sources of confrontation with the US outside the purely economic realm abounds though, and the new national security legislation aimed at Hong Kong is one. State Secretary Pompeo stated the US could ultimately stop treating Hong Kong as a separate economic entity from China, which could seriously disrupt its economy. We could be back to the “trade guerrilla” which characterised 2019.

Given Europe’s reliance on exports, these external developments will be crucial to shape the recovery, but at least the Europeans could try to keep in check their own internal sources of volatility. From this point of view, the Franco-German initiative on the Recovery Fund is reassuring.

The long and winding road

A danger in these moments of crisis when policy-making accelerates in bursts is to shift very quickly from extreme pessimism to hyperbolic comments every time there is progress. This approach to economic commentary adds to volatility rather than helps navigate what is indeed a very treacherous situation. For our part, we consider the Franco German proposal for the Recovery Fund ad a very important step forward towards proper fiscal solidarity, but it is not yet a “Hamiltonian moment”. Some key ingredients are lacking to make this the first step towards financial “federalisation”, on the model of the decision by Hamilton to mutualise the debts of the states after the American revolution. We would add that there was no real federal fiscal cyclical stabilisation capacity in the US before the New Deal in the 1930s. Historical precedents are useful – and we like them a lot in Macrocast – but we should always be very prudent with our selection.

How would the Franco-German proposal work? The principle is simple: the EU would issue debt in the market (directly, not through the European Stability Mechanism or the European Investment Bank) to the tune of EUR 500bn and the proceeds would be apportioned to the regions and sectors most affected by the pandemic shock. The reimbursement of the debt – over a very long period - would be apportioned according to a different key. The Franco-German document did not elaborate on the latter, but we assume that since the proposal is firmly anchored in the negotiation of the Multiannual Financial Framework (MFF) of the EU to cover the 2021-2027 period, it would not be very different from the share of each member state in the EU’s total Gross National Income which is currently used for determining the contributions to the EU budget.

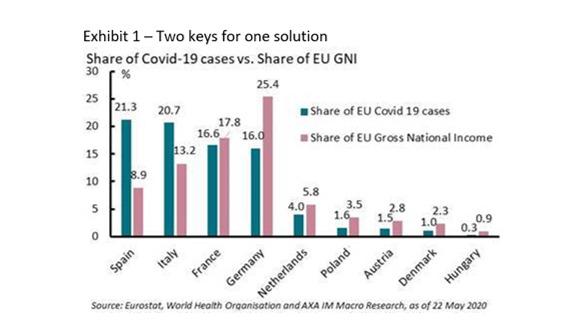

This could provide significant relief to some of the worst-hit countries. We provide here a simple illustration. 20.7% of the total number of covid cases in the EU were observed in Italy. If this was used as the “allocation key”, Italian regions and businesses would receive c. EUR100bn from the Recovery Fund. Since Italy’s share in the EU’s GNI stands at 13.2%, the country would be a net recipient to the tune of EUR 37.5bn, i.e. c.2% of its GDP. On the other side of the spectrum, Germany is much less hit by the pandemic, with only 15% of the cases, while it would shoulder 25.4% of the repayment as per its share in GNI. The country would be a net payer in the system to the tune of 1.4% of its GDP (see Exhibit 1). This would fit a robust definition of fiscal solidarity: expenditure would go to where the need is, payments would mostly come from where the capacity is.

Public health criteria may not be the only guide to the allocation key. There is a strong case to focus instead on the economic damage triggered by the pandemic. It would not change much the position of Italy or Spain relative to Germany. Judging by Q1 GDP, the two southern states are among those with the steepest recessions among the block while Germany is having a milder downturn. Focusing on the economic damage would help fragile countries such as Portugal or Greece which have been dealing comparatively well with the pandemic itself but are facing massive growth destruction as the direct impact of severe lockdown is compounded into Q3 by a challenging tourism season.

One might expect very thorny negotiations on the precise design of the allocation key, even if under any plausible solution Germany is likely to end up as a significant net payer, which makes Angela Merkel’s move even more generous. There is also the risk that the discussion becomes acrimonious if national governments’ handling of the crisis becomes an issue. For instance, Sweden is converging towards the list of worst-hit countries under the public health criteria, while it is not obvious that despite its refusal to implement a lockdown its economic performance will be among the best. Other countries could be reluctant to enter into an arrangement which would benefit a government potentially seen as bearing some responsibility in its own predicament.

It is a theoretical concern at this stage, since Sweden is part of the “frugal four” countries led by Austria which are opposing the Franco-German approach (the other two are Denmark and the Netherlands). Austrian Chancellor Kurz is leading the pack and wants to stick to the notion that fiscal solidarity should continue to take the form of loans. Even though these countries are relatively small and two of them are not even members of the monetary union, their opposition matters.

Since the recovery fund would be incorporated in the EU budget under the Franco-German proposal, unanimity rules apply. To be precise, while qualified majority at the EU council combined with simple majority at the European parliament suffices for the annual budget of the various EU schemes, maximum spending under the MFF requires unanimity of the Council. Paralysis is avoided if no agreement is found by merely rolling the existing spending limits forward, but obviously this means that a new scheme such as the Recovery Fund could not be added (at a bit less than 4% of the EU GDP it would represent a nearly four-fold increase in the overall size of the EU budget).

We should thus expect a long and complex negotiation. We want to believe the “frugal four” opposition to the Franco-German proposal is an opening gambit and that they will ultimately have to accept the principle of the Recovery Fund as laid out by Angela Merkel and Emmanuel Macron. But they will want to trade this against some form of rebate either in the repayment key of the Fund or via other aspects of the MFF. We find it interesting that in the 2 pages-long “non paper” they issued over the weekend mentions that their “position on the Multiannual Financial Framework is unchanged. We continue to request that national contributions are limited, and we recall that the rationale behind corrections remains valid”. It is possible that persistent opposition would trigger some domestic backlash, for instance in Austria where Kurz’ conservatives are in coalition with the more pro-European Greens who, although they have yet to declare their support to the Franco-German initiative, may increasingly feel uncomfortable siding with the proponents of austerity.

Unfortunately, we don’t expect opposition to be limited to the “frugal four”. Before the Recovery Fund initiative was mooted, the number of contentious issues with the Eastern countries was already daunting. They could “play it hard” on the Recovery Fund in exchange for a protection of their share into the “run of the mill” structural funds. Moreover, the Franco-German package has a “Green tinge” in the sense that the recovery spending should support investments contributing to the Green transition. As we have already discussed in Macrocast, the Eastern countries have been increasingly vocal against the Green Pact.

In the meantime, this suggests the ECB will remain on the hook, and we expect “noisy moments” during the negotiations which will trigger some volatility on the most fragile bond markets. The proposal may buy the central bank some time, but this does not change the gist of our discussion in last week’s Macrocast of the ECB options. They will have to increase the size of their Pandemic Emergency Purchase Programme.Public health criteria may not be the only guide to the allocation key. There is a strong case to focus instead on the economic damage triggered by the pandemic

Hamilton has not sung yet

Assuming the proposal goes through and funds start being disbursed in 2021, would this truly qualify as a “Hamiltonian moment” and the beginning of “fiscal federalism”? Well, we think this is premature to assert this.

Hamilton as US Treasury Secretary managed to consolidate under Federal issuance the debt independently incurred by the states during the war of independence. This was part of a more general debate on the form of the new Republic and was seen by Hamilton as one of the steps towards building a strong federal government supporting a modernising economy, against the more decentralised, agrarian model supported by his opponents.

But the crucial ingredient in Hamilton’s project was the emergence of federal tax resources independent of the states (mostly customs duties, since protectionism, to foster the emergence of industry on American soil was another key plank of Hamilton’s economic views). The Franco-German proposal interestingly mentions “introducing fair and effective minimal taxation on the digital economy” but it is not a condition of the deal and does not explicitly appear as an essential clog in the Recovery Fund’s financial engineering. As it is described so far, the resources would come from direct participation from the member states.

Even some of the supporters of the Recovery Fund may prefer to avoid the emergence of direct tax resources since this would make it easier to present the RF as a “one-off” and not as the beginning of fiscal federalism. German Finance minister Scholtz explicitly presented the proposal as a one-off, and the unique nature of the project is obvious. Ignoring the differences in country by country handling, the pandemic is the epitome of an exogenous shock for which no “moral hazard” issue arises. The same characteristic could be found for the legacy debt of the American Revolution. It was the result of a unique national uprising. Interestingly by the way, Hamilton’s bailout of state debt was a one-off. By the late 1830s states were routinely conducting unsustainable financial policies precisely on the assumption of federal support, but by that time the federal government chose to refuse bailouts and the states went through a string of defaults. It is not obvious that political conditions in a normalised, post-covid EU, would be conducive to another step towards fiscal federalism.

In any case, there was no significant federal fiscal federal cyclical stabilisation in the US before the New Deal in the 1930s. A key difference between the US then and Europe today is that the expansion of the federal budget occurred to fill a void, state budgets themselves were too small to provide any significant counter-cyclical protection against the Great Depression. National government spending in Europe is already particularly high, so that coordination, rather than substitution, is the key problem here and now. In a nutshell, even if the ingredients were there in Europe today, and they are not, a Hamiltonian moment in itself would not be enough to deal with our current predicament. We still need to find a way to make our national public debts sustainable. The Recovery Fund would help, but it is no panacea.

Still, politically it is a very important debate. Indeed, so far governments have too often “farmed out” the heavy-lifting of keeping the monetary union together to the ECB, often forcing the central bank to sail very close to the wind when it comes to complying with the spirit of the European Treaty. Even if we think the ECB would be wrong to subject itself to the ruling of the German Constitutional Court (GCC), at some point a democratic decision, rather than a technocratic one, would be welcome. Going through the European budget, as painful as it will be in terms of negotiations, would ensure “due democratic process”, with in particular the involvement of the European parliament. It could be a positive side-effect of the GCC ruling, which may have helped convince Berlin that resorting to monetary policy alone would not be feasible.

The negative option

Anglo-Saxon central banks so far chose to stay away from negative policy rate but given the pressure of the ongoing recession some cracks are appearing, with three leading policy-makers of the Bank of England now showing a more open-minded attitude to the concept.

From a purely macroeconomic point of view – i.e. when ignoring the “financial plumbing” – it would make sense to at least reserve the right to take the policy rate in negative territory. Indeed, if the economy is shifting to “deflation mode” – and the first readings on consumer prices since the start of the pandemic have been pointing to a deceleration in inflation - then keeping a floor at zero for the short end of the curve would ultimately be consistent with rising real rates.

Yet “financial plumbing” can’t be ignored. It’s a point we have made consistently in Macrocast throughout last year. For all the protection they are receiving at the moment from governments in the form of guarantees on loans, banks will probably face very tough conditions in the months ahead. Guarantees cover the new flows of loans, originated as a response to the pandemic shock. They do not cover pre-existing loans and while some of the new flows will make it possible for businesses to service their accumulated debt, ultimately some rise in defaults is unavoidable. With negative rates eating into their profitability, banks would be faced with a “double whammy”.

The ECB though has found a solution to this predicament, by making the banks’ de facto rate they pay to obtain liquidity from the central bank lower than the “tax” the negative deposit rate has created on their excess reserves. This is the rationale behind bringing the interest rate on the Targeted Long-Term Refinancing Operation (TLTRO) to -100 basis points for the “best performers” in terms of lending to the private sector (en passant this means that the central bank accepts at least one of its instruments is structurally loss-making). Technically, this option would exist in the UK. The Bank of England would have to change the conditions on its Term Funding Scheme which is already resembling the TLTROs.

The Fed’s communication on negative rates remains quite dismissive. The words of Jay Powell (“this is not something we are looking at”) last week, coming on top of an elaborate discussion of the drawbacks of such policy suggest their finger is not on this buzzer. We think specific institutional constraints on the Fed, as much as macroeconomic considerations, may be at play here.

In a long blogpost for the Brookings Institution in March 2016 former Fed chairman Ben Bernanke discussed the pros on cons of importing the negative rate policy in the US. His first point was of a legal nature. The Financial Services Regulatory Relief Act of 2006 directs the Fed to pay interest on regular and excess reserves. This might be bypassed by imposing a fee on depositary institutions in exchange for “managing” those reserves, but Bernanke noted that by law any fees charged by the Fed should in the long run be commensurate with the costs the central bank would be incurring. It would be difficult to argue the cost of merely writing a claim by banks on its balance sheet would cost 50 basis points. It is then quite possible that the Fed would need to wait for Congress to change the law before embarking on such policy.

Another key point in Bernanke’s post was the role that money market funds play in the US. With negative rates on the short end of the curve they would have a hard time avoiding “breaking the buck”, i.e. finding themselves unable to return to the fund holders the value of their original investment. This no longer is a legal requirement, but difficulties in this sector could trigger funding difficulties in the corporate sector for instance if this meant that liquidity on the commercial paper market would shrink. The Fed can now rely on other instruments to deal with this (CP is now part of its quantitative easing programme) but this, together with the absence of a scheme which could play exactly the same role as TLTROs in Europe, would be another hurdle to overcome.

The limit to the Fed’s reluctance to consider negative rates at this stage may lie in the exchange rate. If most other central banks go down that path, dollar-denominated cash would gradually become the only one paying a positive interest rate, albeit a paltry one. Ultimately this would add to the upward pressure on the dollar. We are not there, and the sensitivity of the US economy to the exchange rate is relatively low, but if the crisis becomes entrenched, we think the Fed could well have to reconsider its current position.

Not for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.