How will digitalisation create a more resilient post-pandemic world?

- 18 January 2021 (5 min read)

As we approached 2020, it was already clear that the digital revolution was transforming how we live—from how we work, to how we shop, to how we consume entertainment. It has also added a new layer of intelligence to the production and delivery of everything from health care to consumer goods.

This Fourth Industrial Revolution, or Industry 4.0, has been moving at a steady pace as companies have become acquainted with new technologies such as artificial intelligence, machine learning, robotics, automation, 5G and the Internet of Things (IoT).

The speed of digital progress has accelerated dramatically in the wake of the coronavirus, forcing people around the world to move more of their personal and working lives online as quickly as possible. Responses to the coronavirus pandemic have sped up the adoption of digital technologies, and these changes are here to stay. In a matter of months, the pandemic brought about years of change in the way companies across multiple sectors and regions operate.

In a recent survey, McKinsey & Company found that “companies have accelerated the digitalization of their customer and supply-chain interactions and of their internal operations by three to four years. And the share of digital or digitally enabled products in their portfolios has accelerated by a shocking seven years.”1

According to Tom Riley, Head of Global Thematic Strategies at AXA Investment Managers (AXA IM), “These trends have a huge impact on businesses and individuals—but aligning your company to these trends isn’t enough. Even in areas of high structural growth, there will be winners and losers.”

While the digitalization trend will continue to be pervasive across the economy, some sectors will feel its impacts most strongly.

Medicine: A Helping Hand for Health Care

An immediate business focus is on the vaccines that have reached the market. Beyond the frontline response to the coronavirus, an increase in digital applications and innovations is improving access to healthcare in many fields where investors will find opportunities.

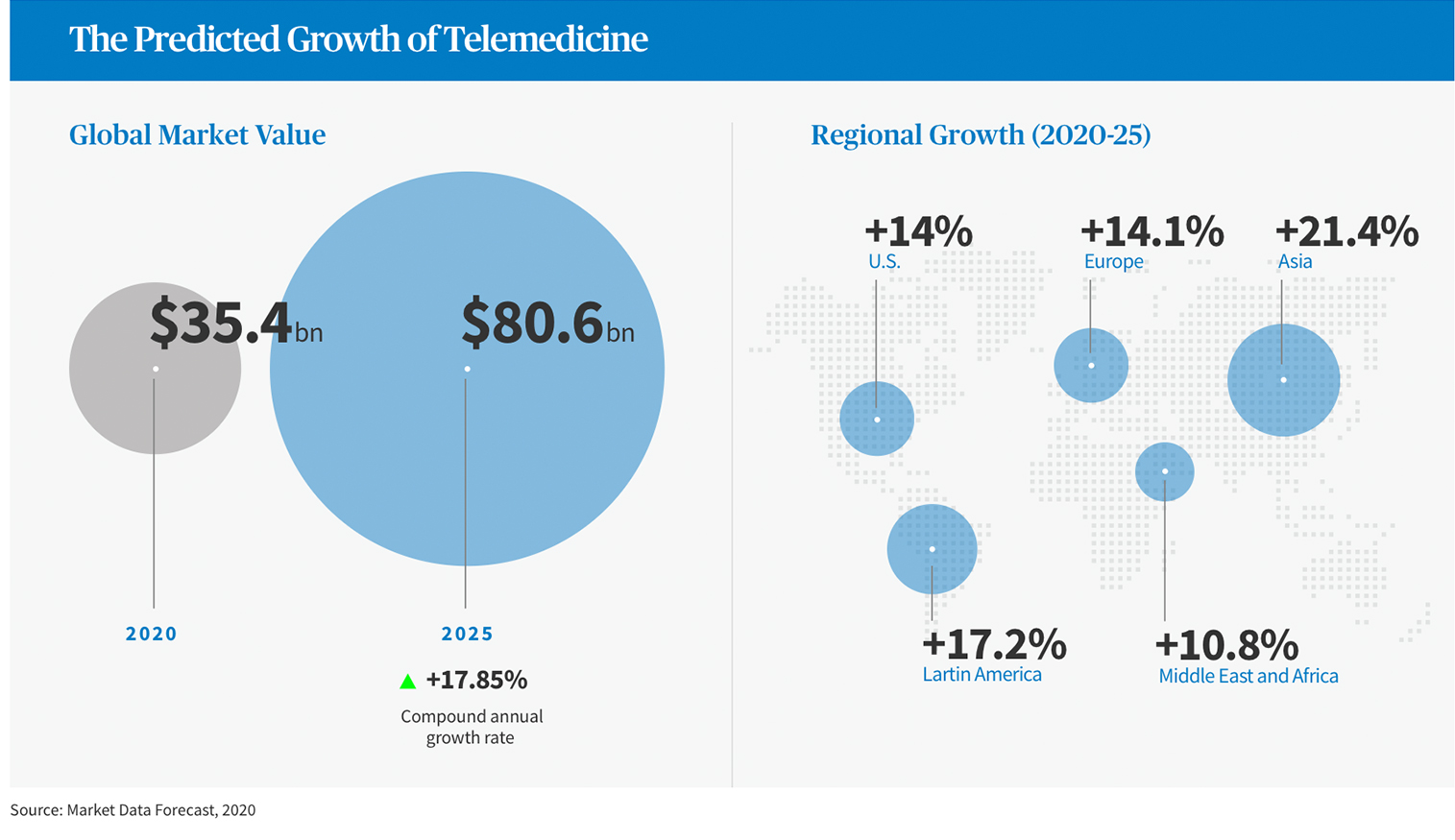

“Telemedicine has seen a massive step change in adoption,” says Riley. “That’s one of the biggest changes for patients in terms of initial contact with the health-care provider.”

Until the coronavirus, telemedicine in the U.S. had progressed slowly, despite more than $4 billion2 flowing into the sector from venture capital funds, and the hopes of governments and health-care providers looking to cut costs and widen access. Some patients were reluctant because of fears over privacy or an unwillingness to embrace the technology, while strict regulations also slowed uptake.

The pandemic has changed all that. Regulators in some U.S. states are now relaxing requirements that doctors be licensed in the same state as their patients. Federal agencies have eased certain rules that protect patient privacy, which could potentially be more easily compromised in telemedicine, “as long as the services are used in good faith and for expanding Medicare coverage to those outside the already-approved rural areas.”3 . Such developments could prove to be a boon for the emergence of nationwide telemedicine services.

At the end of May, McKinsey reported that 46% of consumers in the U.S. were using telehealth services and 76% were interested in doing so, up from 11% a year earlier,4 but growth and subsequent investment opportunities will not be restricted to the U.S. According to Bloomberg, “Economies as diverse as South Korea—with its world-class technology sector—and India, with low health-care costs and a deep pool of doctors, are exploring digital health possibilities at a time when patients may hesitate to visit clinics for fear of catching the virus.”5

Asia-Pacific’s telemedicine market is expected to grow from $8.5 billion this year to $22.5 billion by 2025, according to Market Data Forecast, and Bloomberg reports that “growing acceptance of remote consultations is improving the availability of health care for underserved communities across Asia.”6

In China, online consultation could be set for huge growth, says William Chuang, AXA IM’s Thematics Fund Manager in Hong Kong. “There were 8 billion visits to the doctor in China last year. If you can redirect even 1% of those patients to online consultation, that’s a huge market, and it helps alleviate the pressure on the healthcare system, too.”

China is one of many markets where startups are using Big Data techniques to help medical research. “Connecting IT and record systems within the country’s 33,000 hospitals and then connecting them to third-party institutions can make a huge difference in improving the efficiency of the entire system,” says Chuang.

The pandemic is likely to increase governments’ focus on fostering domestic healthcare champions that have the capacity to produce vaccines and other drugs in their home markets, such as the U.K.’s AstraZeneca and Pfizer in the U.S. “The initial stages of the pandemic reminded people how important these large health-care companies are to the country they reside in,” Riley says. “It’s important to governments to have national champions to help support critical health-care infrastructure.”

For investors, this will likely ensure continued access to a wide range of pharma and health-care champions, but some governments may consolidate opportunities because of a desire to support national champions.

Logistics: Unlocking Value in the Supply Chain

Modern supply chains, set up to take advantage of cost-efficient production processes across the world, have become increasingly extended and complex. But the pandemic has prompted more enterprises to source closer to home.

“Today’s globalized supply chain network has been optimized to identify minimum lead times at the lowest possible price,” says Professor Carlos Cordon of IMD Business School. However, Cordon believes political developments, a trend in consumers increasing buying niche products and the global pandemic have exposed the weaknesses that lie at the heart of this manufacturing model. “The hidden costs of single-source dependencies and poor flexibility in adapting to real-time shocks have been laid bare,” he says.7

The U.S.-China trade war had already put supply chains and logistics under scrutiny. “The idea that you could be impacted quite substantially by something happening on the other side of the world is quite important when you’re managing your supply chain,” Riley points out.

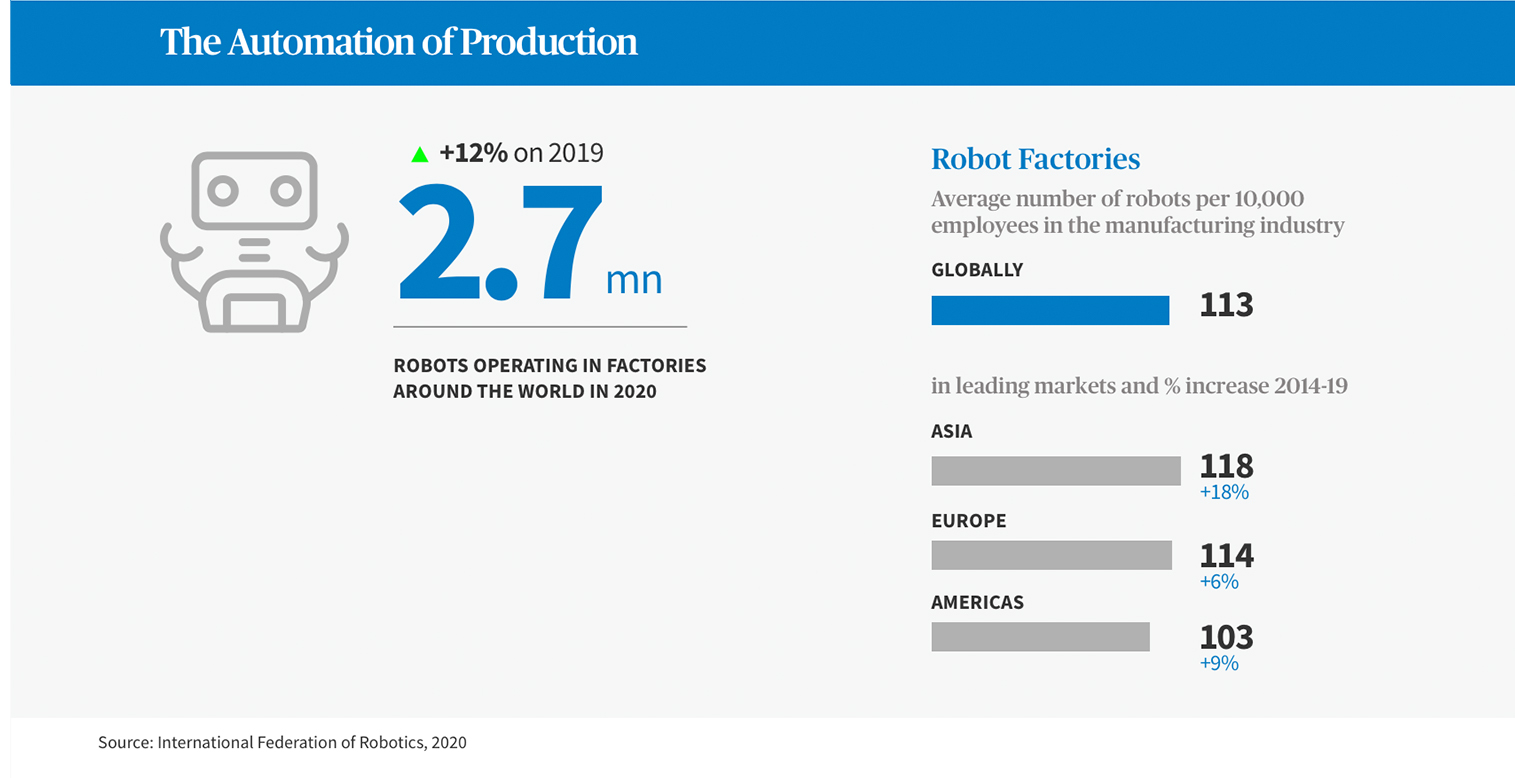

The trade war and increasing disruptions caused by natural disasters have highlighted the fragility and complexity of many supply chains. At the same time, increased adoption of robotics and automated technologies “has started to chip away at some of the advantages you get from having low-cost manufacturing,” says Riley. “Covid and the trade war have highlighted the geopolitical benefits of having manufacturing on your doorstep.”

In addition, the prevailing view that just-in-time manufacturing and fulfillment—stock delivered as it’s required in a bid to reduce storage costs—are the best way to run supply chains is changing, Chuang believes. “Coming out of the pandemic, we may see businesses moving away from just-in-time to holding more stock to ensure that they don’t run out in the case of a disruption.”

As the coronavirus has spread, it has led to lockdowns, safety measures and border closures that have restricted the movement of goods. Trucks formed 37-mile-long lines on Poland’s A4 highway after the country closed its border with Germany in mid-March.8 In India, the lockdown created a shortage of truck drivers, “which resulted in over 50,000 containers piling up in the ports of Chennai, Kamajarar and Kattupalli.”9

These disruptions reinforced the need for cargo visibility and traceability. “This would entail investments in technology, such as the IoT, cloud computing, automation and data analytics. In the long term, robotics, drones and autonomous vehicles might reduce logistics services providers’ exposure to labor shortages,” states the International Finance Corporation in its recent report, “The Impact of Covid-19 on Logistics.”10

The capabilities of such technologies will be supercharged by the arrival of 5G, which will also enable new business models that currently we can only speculate about, Riley says.

Chuang says that many suppliers are exploring the use of “factories that are almost completely automated” that take advantage of the arrival of comparable-quality but cheaper Chinese robots, which allow them to both maintain margins and compensate for a labor shortage that has been exacerbated by the lockdown. This backdrop represents a potentially huge opportunity to invest in enterprises providing the skills of the future to the next generation of workers, many of who could be working alongside robotic counterparts.

New opportunities in robotics, automation and digitalization exist across a range of sectors, as logistics providers seek to redefine themselves as end-to-end providers that can help customers react more quickly to unexpected events and rapid changes in customer demand. Near-shoring supply chains may create opportunities to invest in new, state-of-the-art production facilities closer to end markets.

Retail: The Dramatic Growth of E-Commerce

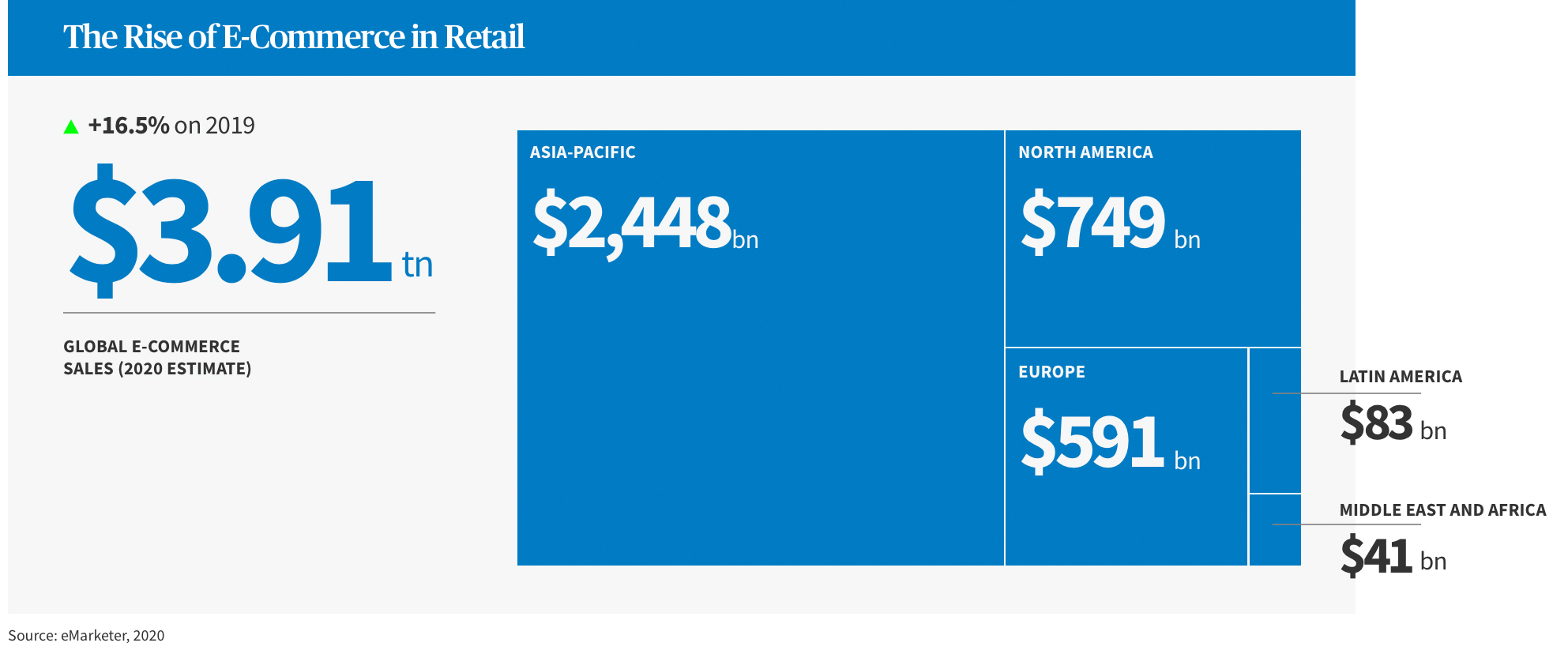

With many non-essential stores shuttered, lockdowns have fueled a surge in online shopping, which is changing the nature of the e-commerce sector that increasingly exists only as a collection of brands and supply chains. As a result, “demand for logistics technologies and warehouse automation technologies has gone through the roof,” Riley says. Amazon recently announced that by the end of 2020, it will have 50% more logistics capacity than it did at the end of 2019. In China, e-commerce now accounts for 30% of the retail market.

“Covid-19 has broadened the categories that have benefited from the shift to e-commerce to areas that traditionally have had lower penetration, such as online grocery and home furniture,” Riley explains. There has also been a notable increase in smaller traders moving online, which is now much easier for them to do than in the past, “thanks to the growth of payment ecosystems, easy website builders and companies like Shopify or Etsy,” he says.

One extension of this trend set to take off is “streaming e-commerce,” or live selling, which“allows almost anyone (celebrities, influencers or your local store owner) to quickly create their own shopping television channel that’s also a social network and e-commerce platform—at a tiny fraction of the cost.”11

By intertwining streaming video, social media and celebrity into a shopping experience, innovative sellers have the potential to further disrupt an already-battered retail industry.

As different regions move in and out of lockdown, live selling provides more information than traditional advertising and can create engagement, loyalty and an emotional connection between host and consumer akin to that between a shopkeeper and their customers.

In China, companies are testing a range of new transactional concepts, from facial-recognition and other biometric payment systems to fully automated convenience stores.12

Another key trend is the growth of online-to-offline (O2O) strategies. “This is one of the areas with the biggest growth potential,” Chuang says. “An offline presence can be a good way for online businesses to gather insightful consumer data, serve as a logistic hub and enable faster delivery.”

While Amazon’s purchase of Whole Foods is one example of this trend, it appears to be a primarily Chinese phenomenon at present, led by companies such as Alibaba and a joint venture between real estate company Evergrande and tech giant Tencent.13

Another primarily Chinese trend that is spreading West is the growth of community purchase groups or cooperatives, where local communities come together to generate savings by buying in bulk, creating another revenue stream for wholesalers.

The growth in e-commerce is creating opportunities in areas ranging from distribution and warehousing to payment systems, website players and platforms such as Shopify.

Renewable Power: A Digital Opportunity for Clean Energy

The pandemic has also been notable for what it didn’t do to the energy sector: slow down the shift to renewables. In many countries it has actually accelerated the trend, as governments look to invest in clean energy and electric vehicles (EVs) to kick-start a green recovery. A series of net-zero declarations have issued from China, South Korea and Japan, as well as an incoming U.S. President who has pledged to put climate change at the heart of his administration.

Digitalization will play a key role in the energy sector as it continues to decarbonize—not least because investments in clean power, EV charging infrastructure and efficiency measures are powerful job creation tools. According to Bloomberg Intelligence, U.S. government spending on renewables and energy efficiency creates five times more jobs per $10 million invested than spending on fossil fuels.

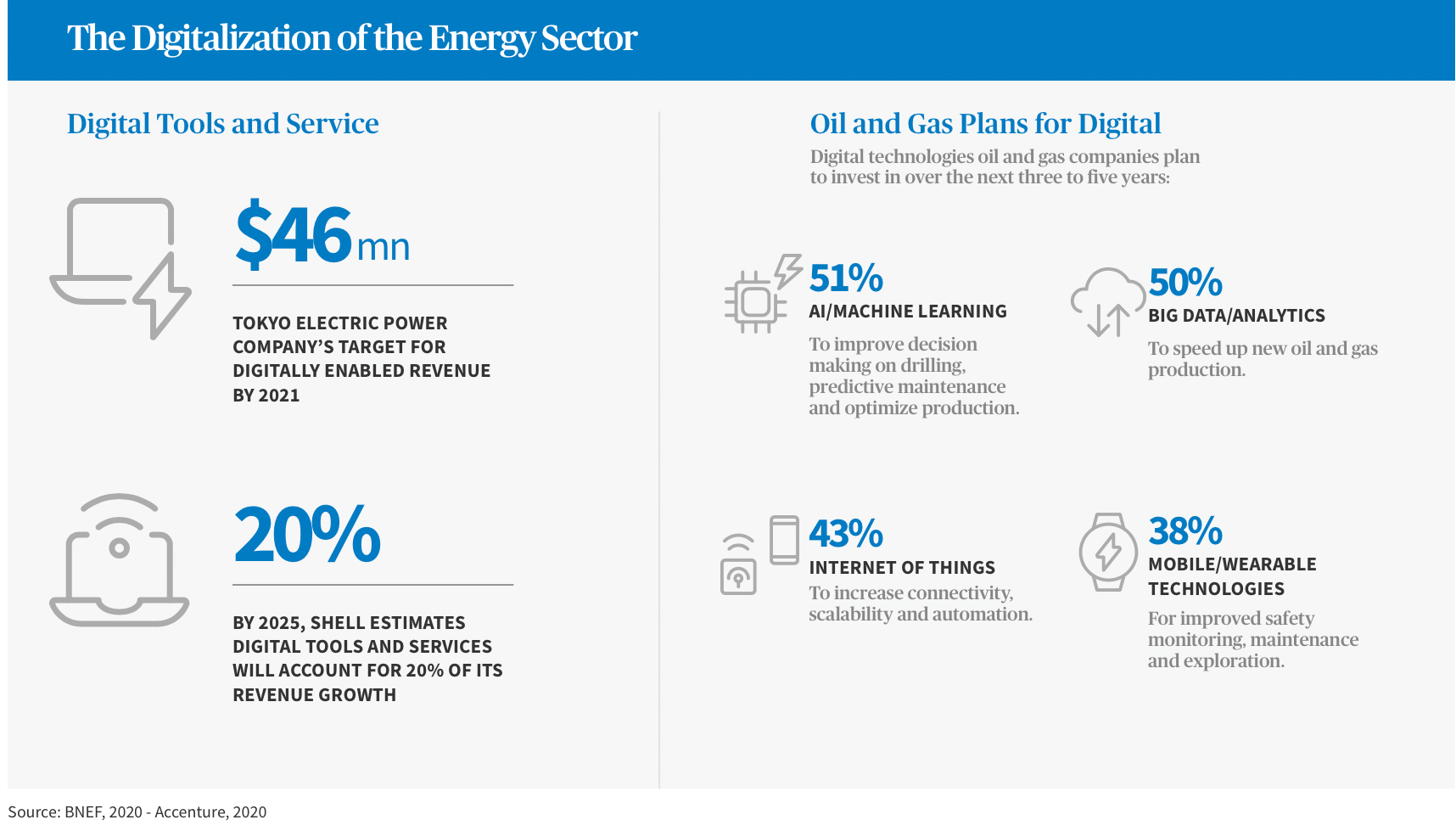

BloombergNEF (BNEF) reports that “energy companies are building digital products and services to strengthen their existing businesses and diversify into new revenue streams.”13 14 For oil and gas companies, digital is a double-edged sword that is helping them to become more efficient in their operations while simultaneously enabling EVs and renewable power to eat into their traditional markets.

“The Covid-19 pandemic, and resultant economic fallout, will make some energy companies interested in diversification. The virus is pushing many digital technologies (such as remote monitoring, automation, drones and AI analytics) faster than previously expected,” BNEF reports, while also noting that the sector has been hard hit by the fall in demand caused by the pandemic, limiting the resources available to spend on digital technologies.

Many digitalization measures make renewable energy more efficient and cheaper. For example, in the operation and maintenance of wind farms, drones combined with virtual and augmented reality cut the cost and improve the safety of turbine inspections, while advanced predictive analytics help identify faults in advance and increase the effectiveness of preventive maintenance.

Smart grids will help integrate more renewable and distributed energy, along with growing amounts of battery storage, into the energy system. “Digital tools can balance these inherently less predictable forms of energy, but you can also start to make the pricing more dynamic to encourage EV charging at off-peak times,” says Riley. “It can also enable people with home battery storage systems or electric vehicles to get paid for pumping power back into the grid at times of high demand.”

Renewable energy will continue to be a huge opportunity as technological advances continue to drive down costs, and battery storage will follow suit, supercharged by the rollout of electric vehicles. There will also be an increased focus on energy efficiency, particularly in buildings. The decarbonization and electrification of heat and transport will also be megatrends that will shape markets for decades to come.

Decarbonization efforts will significantly influence infrastructure investments, with many governments keen to support the establishment of a hydrogen economy that will initially focus on decarbonizing gas power plants and hard-to-abate industries such as steelmaking and shipping.

Technology: Data Security in the Era of Cloud Services

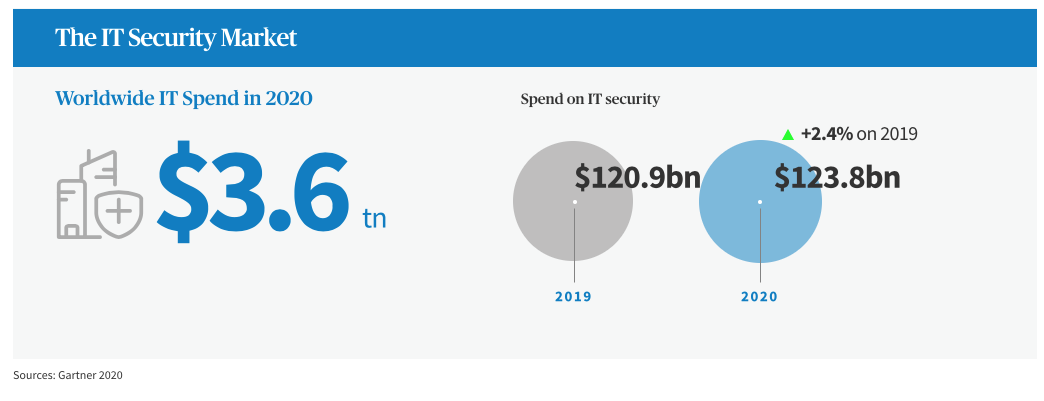

The shift to a more digital world has increased the importance of data security. This trend has been exacerbated by the global lockdowns that have forced people to work and shop from home, and current levels of digitalization and security will remain even when the pandemic recedes.

Companies have scrambled to ensure that the correct cybersecurity protocols are in place for remote working. “There’s a huge amount of spend in the IT infrastructure underpinning all of this so that we can do it in a safe, secure and reasonably reliable way,” Riley says. “Corporate networks are potentially more vulnerable when there are thousands of endpoints in people’s homes rather than in a traditional office.”

“As demand grows for 5G, cloud and IoT technologies, companies need new security products,” Chuang points out. In China, the cybersecurity market is very fragmented, and the next decade is expected to see a period of consolidation and the emergence of Chinese national champions. There will also be a shift from spending on hardware, which still accounts for about half of spending in security—a much higher proportion than other markets—to software, as platform-as-a-service (PaaS) and software-as-a-service (SaaS) models and markets grow.

Globally, much of this activity is linked to fintech, and online payments are a crucial area of focus to ensure that consumers have confidence in buying goods on the internet.

Companies helping businesses to enable their staff to work from home more securely will be well placed, as digital security will have to account for the huge growth in cloud services and IoT and the growth of 5G, says Chuang.

“The cybersecurity market is growing at a rate of 20% a year, but it is still quite fragmented because it is a relatively new market. In the next five to 10 years, we will see a lot of consolidation,” he says.

Future: Moving Past the Pandemic

The pandemic has created huge upheavals in markets around the world that are still playing out. However, with this disruption comes opportunity. The most obvious are in health care, but the coronavirus has accelerated huge trends in many other sectors, including the replacement of fossil fuels with renewable energy sources, and a shift from brick-and-mortar shopping to online retail, which is also leading the revolution in logistics and supply chains. Many of the developments in these sectors are being facilitated or led by the digital revolution, which is bringing efficiencies to existing sectors as well as opening up new markets and business models. But the digital revolution has also created new vulnerabilities to potential bad actors, and cybersecurity will continue to be both an essential part of every company’s digital journey and a huge investment opportunity.

“When the lockdown came, we all moved our lives online immediately—shopping, working, leisure,” says Riley. “That couldn’t have happened without the digital infrastructure that underpins all this. This is often something that people don’t see, but there are some really interesting investment opportunities there.”

- aHR0cHM6Ly93d3cubWNraW5zZXkuY29tL2J1c2luZXNzLWZ1bmN0aW9ucy9zdHJhdGVneS1hbmQtY29ycG9yYXRlLWZpbmFuY2Uvb3VyLWluc2lnaHRzL2hvdy1jb3ZpZC0xOS1oYXMtcHVzaGVkLWNvbXBhbmllcy1vdmVyLXRoZS10ZWNobm9sb2d5LXRpcHBpbmctcG9pbnQtYW5kLXRyYW5zZm9ybWVkLWJ1c2luZXNzLWZvcmV2ZXI=

- aHR0cHM6Ly93d3cuYmxvb21iZXJnLmNvbS9uZXdzL2FydGljbGVzLzIwMjAtMDMtMjMvaW52ZXN0b3JzLWJldC1iaWxsaW9ucy1vbi12aXJ0dWFsLW1kcy1iZWZvcmUtdmlydXMtZnVlbGVkLWEtYm9vbT9zcmVmPW14RmlHMk9N

- SWJpZC4=

- aHR0cHM6Ly93d3cubWNraW5zZXkuY29tL2luZHVzdHJpZXMvaGVhbHRoY2FyZS1zeXN0ZW1zLWFuZC1zZXJ2aWNlcy9vdXItaW5zaWdodHMvdGVsZWhlYWx0aC1hLXF1YXJ0ZXItdHJpbGxpb24tZG9sbGFyLXBvc3QtY292aWQtMTktcmVhbGl0eQ==

- aHR0cHM6Ly93d3cuYmxvb21iZXJnLmNvbS9uZXdzL2FydGljbGVzLzIwMjAtMDctMjMvcGFuZGVtaWMtYm9sc3RlcnMtY2FzZS1mb3ItdGVsZW1lZGljaW5lLWFjcm9zcy1hc2lhLXBhY2lmaWM/c3JlZj1teEZpRzJPTQ==

- aHR0cHM6Ly93d3cuYmxvb21iZXJnLmNvbS9uZXdzL2FydGljbGVzLzIwMjAtMDctMjMvcGFuZGVtaWMtYm9sc3RlcnMtY2FzZS1mb3ItdGVsZW1lZGljaW5lLWFjcm9zcy1hc2lhLXBhY2lmaWM/c3JlZj1teEZpRzJPTQ==

- aHR0cHM6Ly93d3cuaW1kLm9yZy9yZXNlYXJjaC1rbm93bGVkZ2UvYXJ0aWNsZXMvQS1wb3N0LUNPVklELTE5LW91dGxvb2stVGhlLWZ1dHVyZS1vZi10aGUtc3VwcGx5LWNoYWluLw==

- aHR0cHM6Ly93d3cuaXJpc2h0aW1lcy5jb20vbmV3cy93b3JsZC9ldXJvcGUvY29yb25hdmlydXMtaHVnZS10cmFmZmljLWphbXMtYXMtZXUtY291bnRyaWVzLWNsb3NlLWJvcmRlcnMtMS40MjA1ODQ2

- aHR0cHM6Ly93d3cudGhlaGluZHVidXNpbmVzc2xpbmUuY29tL2Vjb25vbXkvbG9naXN0aWNzL292ZXItNTAwMDAtY29udGFpbmVycy1zdHVjay1hdC0zLW1ham9yLXBvcnRzLWluLWNoZW5uYWkvYXJ0aWNsZTMxMjYzMjYyLmVjZQ==

- aHR0cHM6Ly93d3cuaWZjLm9yZy93cHMvd2NtL2Nvbm5lY3QvMmQ2ZWM0MTktNDFkZi00NmM5LThiN2ItOTYzODRjZDM2YWIzL0lGQy1Db3ZpZDE5LUxvZ2lzdGljcy1maW5hbF93ZWIucGRmP01PRD1BSlBFUkVTJmFtcDtDVklEPW5hcU9FRDU=

- aHR0cHM6Ly93d3cuYmxvb21iZXJnLmNvbS9uZXdzL2ZlYXR1cmVzLzIwMjAtMDktMTQvd2hhdC1pcy1saXZlc3RyZWFtLXNob3BwaW5nLWl0LXMtdGhlLWZ1dHVyZS1vZi11LXMtZS1jb21tZXJjZT9zcmVmPW14RmlHMk9N

- aHR0cHM6Ly93d3cuYmxvb21iZXJnLmNvbS9uZXdzL2ZlYXR1cmVzLzIwMTgtMTAtMTgvY2hpbmEtaXMtdGhlLXdvcmxkLXMtcmV0YWlsLWxhYm9yYXRvcnk/c3JlZj1teEZpRzJPTQ==

- aHR0cHM6Ly9hc2lhLnJlZGFudC5jb20vaG93LWZvdXItYnJhbmRzLXVzZWQtbzJvLWZvci1iZXR0ZXItcmV0YWlsLXNhbGVzLWluLWNoaW5hLw==

- aHR0cHM6Ly9hc2lhLnJlZGFudC5jb20vaG93LWZvdXItYnJhbmRzLXVzZWQtbzJvLWZvci1iZXR0ZXItcmV0YWlsLXNhbGVzLWluLWNoaW5hLw==

- Qk5FRiBCdWlsZGluZyBhIFNvZnR3YXJlIEJ1c2luZXNzOiBhIEd1aWRlIGZvciBFbmVyZ3kgQ29tcGFuaWVzLCBNYXkgMjYsIDIwMjAu

Not for Retail distribution

This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries. © 2021 AXA Investment Managers. All rights reserved