What is automation?

Automation is the creation and application of technologies to improve or optimise processes. Automation began life on the factory floor, as automotive companies aimed to improve manufacturing techniques, but has since evolved to influence multiple aspects of how we live and work.

What are the potential benefits of investing in automation?

Automation can help companies:

- Increase efficiency and lower costs

- Improve reliability and consistency

- Perform highly sophisticated and delicate tasks

- Work safely alongside human workers

- Keep pace with customers’ increasingly on-demand preferences

Expected annual growth of the global robotics market until 20251

While we are still in the early stages of this disruptive trend, its long-term potential seems evident to a growing number of equity investors. With an opportunity set across both larger and smaller companies, robotics is increasingly being recognised as a viable investment and potentially superior growth area of the market.

Our Robotech strategy

Our Robotech strategy seeks to provide investors with access to the long-term superior growth potential of the robotics market, an expanding area of the economy with an increasing number of small and mid-cap investment opportunities. This includes:

- Industrial automation: Technologies helping companies increase precision, reliability and efficiency across industries.

- Transport: Technological advances focused on vehicle safety and the pathway towards autonomous vehicles. Additional opportunities outside of the car industry in areas such as agriculture and mining.

- Healthcare: Companies involved in robotic surgery, assistance and remote healthcare.

- Technology enablers: The intelligence that powers and controls robotics. This provides the sensors, connectivity and intelligence used to gather and analyse information

Why invest in automation now?

The demand for industrial robots has accelerated in recent years due to the ongoing trend towards automation and innovative technological advancements. Advances in technology have made robots capable of performing highly sophisticated and delicate work as well as working alongside humans to drive productivity and efficiency.

We believe this is just the beginning of a multi-decade theme:

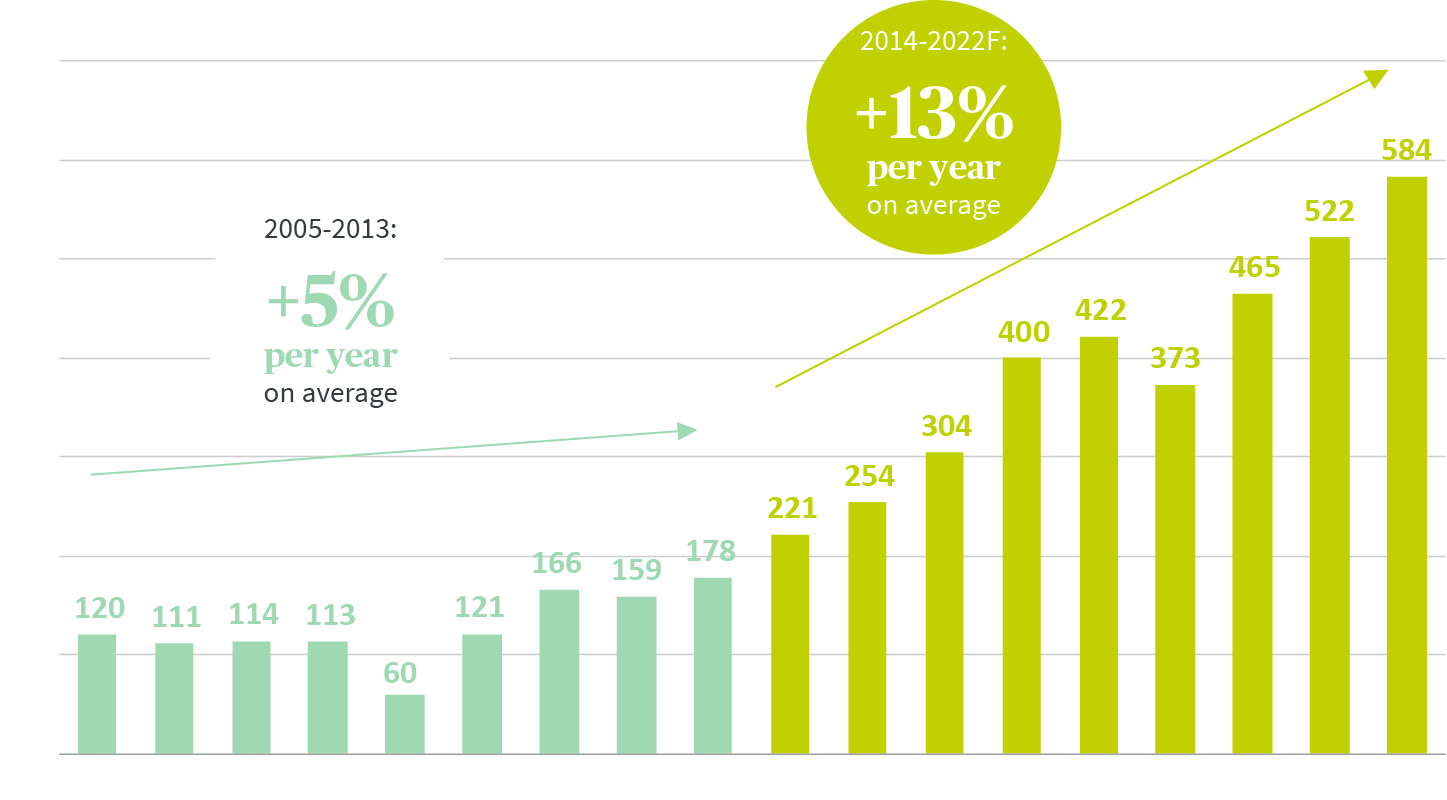

Worldwide supply of industrial robots (units in thousands)

Source: AXA IM / IFR World Robotics 2021’

Robots are being used across more industries

As robots become smarter, more flexible and increasingly capable of working alongside humans, they are being used across more industries:

- Alongside the automotive market, the semiconductor and electronics industry is the main user of industrial robots.

- The food and beverage industry has been one of the fastest-growing areas in terms of robotic use over the past few years.

- Robotic precision is also useful for repetitive or dangerous jobs, such as hazardous materials testing.

Robots are also becoming more affordable while labour cost is increasing and the working population is shrinking in many countries.

Visit your local fund centre

Our strategy offers access to the long-term growth potential of the rapidly expanding robotics market across multiple industries.

View fundsTo help people invest in the companies that are embracing these changes, we have adapted our internal research capabilities to incorporate the five main trends that we believe represent the future for long-term fundamental growth investing.

Ageing and lifestyle

Ageing population trends are creating opportunities for long-term growth investors due to growing demand for healthcare, leisure, wellness, housing and more.

Connected consumer

Digitalisation empowers consumers like never before with 24 hour, mobile access to a vast choice of products - companies must evolve to remain competitive.

Clean Economy

Innovative companies are creating solutions to address pressures on scarce natural resources and the need for greenhouse gas emission reduction.

Transitioning societies

A rapidly growing global middle class is likely to create growth opportunities as goods and infrastructure demand shifts from the basic to the aspirational.

Evolving Trends

Discover a single point of access to the five major long-term growth themes we have identified in the evolving economy.

Risks

No assurance can be given that the Robotech strategy will be successful. Investors can lose some or all of their capital invested. The Robotech strategy is subject to risks including counterparty risk, geopolitical risk, liquidity risk, credit risk, and the impact of any techniques such as derivatives.

Disclaimer

This promotional communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.